Build Your Position

0/10 legsPreset Strategies

P&L Analysis

Calculating...Add positions to see the P&L diagram

Key Metrics

Position Summary

| Type | Direction | Strike | Premium | Qty |

|---|

Understanding Option Payoff Diagrams

How to Use This Tool

- Set your parameters - Enter the current stock price, expiration date, implied volatility, and risk-free rate in the top section

- Build your position - Click "Add Option Leg" to add calls or puts, or "Add Stock" for a stock position. Set the strike price, premium, direction (long/short), and number of contracts for each leg

- Use presets - Or quickly load common strategies like covered calls, spreads, or iron condors from the Preset Strategies section

- Analyze results - View your P&L chart, max profit/loss, breakeven points, and estimated probability of profit in real-time

- Toggle curves - Use the checkboxes to show/hide the "At Expiration" and "Today" P&L curves

What is a Payoff Diagram?

A payoff diagram (or profit/loss diagram) shows your potential profit or loss across different stock prices. The X-axis represents the underlying stock price, while the Y-axis shows your profit or loss in dollars.

Reading the Chart

- Solid blue line (At Expiration) - Shows P&L if you hold until expiration

- Dashed lines - Show P&L at earlier dates, accounting for time value

- Zero line - Where the chart crosses zero is your breakeven point

- Above zero - Profitable territory

- Below zero - Loss territory

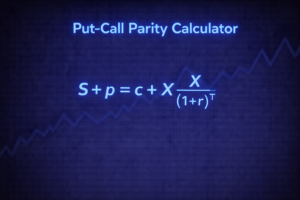

Time Value and Black-Scholes

Before expiration, options have time value in addition to intrinsic value. This calculator uses the Black-Scholes model to estimate option prices at different dates before expiration.

Common Strategies

Bullish Strategies

- Long Call - Unlimited upside, limited downside

- Bull Call Spread - Capped profit, reduced cost

- Covered Call - Income on stock you own

Bearish Strategies

- Long Put - Profit when stock falls

- Bear Put Spread - Capped profit, reduced cost

- Protective Put - Insurance for long stock

Important Disclaimer

This calculator is for educational purposes only. Actual option prices and P&L may differ due to market conditions, bid-ask spreads, dividends, early exercise (American options), and other factors. Options trading involves significant risk of loss. This is not financial advice.