Long Strangle Parameters

Long Strangle Quick Reference

P/L at Expiration:

If S < Kput: P/L = (Kput - S - Total Premium) × 100 × Qty

If Kput ≤ S ≤ Kcall: P/L = (-Total Premium) × 100 × Qty

If S > Kcall: P/L = (S - Kcall - Total Premium) × 100 × Qty

Key Terms:

- S = Stock price at expiration

- Kput = Put strike price

- Kcall = Call strike price

- Total Premium = Call Premium + Put Premium

- Upper Breakeven = Kcall + Total Premium

- Lower Breakeven = Kput - Total Premium

- Max Profit = Unlimited (upside); capped at (Kput - Total Premium) × 100 × Qty (downside, at S = $0)

- Max Loss = Total Premium × 100 × Qty (both expire worthless)

Key Metrics

Formula Breakdown

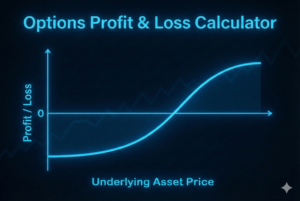

P/L Diagram

Understanding Long Strangles

What Is a Long Strangle?

A long strangle involves buying an out-of-the-money (OTM) put and an OTM call on the same underlying stock with the same expiration date. Unlike a covered call or protective put, the long strangle has no stock position — it consists entirely of options.

The strategy profits when the stock makes a large move in either direction, beyond one of the two breakeven prices. It is popular before earnings announcements, major economic events, or whenever a trader expects significant volatility but is uncertain about direction.

Key Characteristics

- Max Profit (upside): Unlimited — the call gains value without limit as the stock rises beyond the upper breakeven.

- Max Profit (downside): Finite — capped at (Kput - Total Premium) × 100 × Qty at S = $0. The stock can only fall to zero.

- Max Loss: Total Premium × 100 × Qty (both options expire worthless when stock stays between the strikes).

- Upper Breakeven: Call Strike + Total Premium per share

- Lower Breakeven: Put Strike - Total Premium per share

- Outlook: Neutral on direction, bullish on volatility (expects a big move)

- Cost: Net debit (sum of both premiums paid)

- Time Decay: Works against the position — both options lose value as expiration approaches

How to Read the P/L Chart

The solid blue line (At Expiration) shows the long strangle payoff: a V-shape with a flat bottom between the two strikes. Between Kput and Kcall, the P/L is flat at the maximum loss (total premium paid). Below Kput, profit increases as the stock falls (put gains value). Above Kcall, profit increases as the stock rises (call gains value).

The dashed dark blue line (Today / T+0) represents the theoretical P/L at trade entry, computed using Black-Scholes for both legs. The smooth U-shaped curve shows how the combined position value changes with the stock price while time value remains in both options.

IV Mode vs. Premium Mode

IV Mode: Enter a single implied volatility, and the calculator uses Black-Scholes to estimate both the call and put premiums. This mode also enables the “Today (T+0)” P/L curve on the chart. Note: the same IV is used for both legs, which is a simplification — in real markets, the call and put may have different implied volatilities (volatility skew).

Premium Mode: Enter the exact premium for each leg separately. Useful when you know the actual market prices. Only the expiration payoff curve is shown because IV is needed to compute theoretical values before expiration.

When to Use a Long Strangle

- Before earnings announcements or other catalysts that may cause a big move

- When you expect high volatility but are unsure of the direction

- When implied volatility is relatively low (cheaper premiums, more room for IV expansion)

- As an alternative to a long straddle when you want lower upfront cost

- For event-driven trading (FDA decisions, elections, macro announcements)

Frequently Asked Questions

Disclaimer

This calculator is for educational purposes only. Options trading involves significant risk of loss. The long strangle involves two separate option legs. Actual option prices and P/L may differ due to market conditions, bid-ask spreads, dividends, early exercise (American options), and other factors. The Black-Scholes model makes simplifying assumptions including constant volatility, European-style exercise, and identical IV for both legs. This is not financial advice. Consult a qualified professional before making investment decisions.

Related Calculators

Course by Ryan O'Connell, CFA, FRM

Options Mastery: From Theory to Practice

Master options trading from theory to practice. Covers fundamentals, Black-Scholes pricing, Greeks, and basic to advanced strategies with hands-on paper trading in Interactive Brokers.

- 100 lessons with 7 hours of video

- Black-Scholes, Binomial & Greeks deep dives

- Basic to advanced strategies (spreads, straddles, condors)

- Hands-on paper trading with Interactive Brokers