Option Strategy Calculator for Spreads, Straddles & More

Build and analyze complex option strategies with this comprehensive option strategy calculator. Input market parameters, strike prices, and volatility to evaluate profit and loss profiles for 8 popular option strategies including spreads, straddles, strangles, covered calls, and protective puts.

Master Option Strategies with Advanced Calculations

The option strategy builder is an essential tool for options traders looking to understand the risk-reward dynamics of complex multi-leg option positions. Unlike single-option calculators, this comprehensive tool evaluates complete strategies by combining multiple option positions and analyzing their collective profit and loss profiles across different market scenarios. Whether you’re implementing bull call spreads or sophisticated straddle strategies, this calculator provides the analytical foundation for informed trading decisions.

What This Option Strategy Calculator Provides:

This advanced tool calculates and visualizes:

- Theoretical Strategy Valuation: Uses Black-Scholes pricing to determine strategy values and required capital based on your inputs.

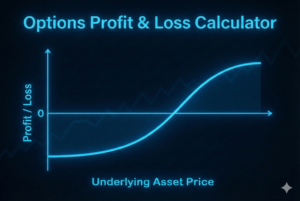

- Interactive Profit & Loss Charts: Visual representation of strategy performance across different stock price levels at expiration.

- Maximum Profit/Loss Analysis: Calculates theoretical maximum gains and losses for each strategy type.

- Break-even Points: Identifies exact stock price levels where the strategy becomes profitable.

- Strategy Comparison: Evaluate multiple strategies side-by-side to choose the optimal approach for your market outlook.

Understanding option strategy dynamics is crucial for advanced traders implementing sophisticated approaches like volatility trading and hedging strategies.

How to Use the Option Strategy Calculator:

- Select Strategy Type: Choose from 8 pre-configured option strategies based on your market outlook.

- Enter Current Stock Price ($): The current market price of the underlying asset you’re trading.

- Enter Volatility (%): The expected annualized volatility of the underlying stock.

- Enter Risk-Free Rate (%): The current annualized risk-free rate (typically Treasury bill rate matching your option’s expiration timeframe).

- Enter Days to Expiration: The number of calendar days remaining until option expiration.

- Enter Strike Prices: Input the strike prices for each leg of your chosen strategy.

- Analyze Results: Review the strategy summary, profit/loss chart, and maximum risk/reward calculations.

Bull Call Spread Strategy

Strategy Overview:

A bull call spread involves buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price, both with the same expiration date. This strategy creates a limited-risk, limited-reward position that profits from moderate upward price movement in the underlying asset.

Investor Outlook:

Traders implement bull call spreads when they have a moderately bullish outlook on the underlying stock. This strategy is ideal when you expect the stock to rise but want to reduce the cost of the long call position and limit exposure to time decay and volatility changes.

Risks and Rewards:

- Maximum Profit: (Higher Strike – Lower Strike) – Net Premium Paid

- Maximum Loss: Limited to the net premium paid for the spread

- Break-even Point: Lower strike price + net premium paid

- Risk Profile: Limited risk, limited reward with defined profit zone

Video Tutorial: Bull Call Spreads Explained

Learn how bull call spreads work, when to use them, and how to calculate profit and loss scenarios in this comprehensive tutorial.

Bear Put Spread Strategy

Strategy Overview:

A bear put spread involves buying a put option at a higher strike price while simultaneously selling a put option at a lower strike price, both with the same expiration date. This creates a limited-risk position that profits from moderate downward price movement.

Investor Outlook:

Bear put spreads are implemented when traders have a moderately bearish outlook on the underlying stock. This strategy allows you to profit from declining prices while reducing the cost compared to buying puts outright and limiting exposure to volatility risk.

Risks and Rewards:

- Maximum Profit: (Higher Strike – Lower Strike) – Net Premium Paid

- Maximum Loss: Limited to the net premium paid for the spread

- Break-even Point: Higher strike price – net premium paid

- Risk Profile: Limited risk, limited reward with defined profit zone

Video Tutorial: Bear Put Spreads Explained

Understand bear put spread mechanics, optimal market conditions, and profit calculations with this detailed explanation.

Long Straddle Strategy

Strategy Overview:

A long straddle involves buying both a call option and a put option at the same strike price and expiration date. This strategy profits from significant price movement in either direction, making it ideal for high-volatility scenarios.

Investor Outlook:

Long straddles are used when traders expect high volatility but are uncertain about direction. This strategy is popular around earnings announcements, FDA approvals, or other events that could cause significant price swings.

Risks and Rewards:

- Maximum Profit: Theoretically unlimited (stock price moves significantly in either direction)

- Maximum Loss: Limited to total premium paid for both options

- Break-even Points: Strike price ± total premium paid

- Risk Profile: Limited downside, unlimited upside potential

Short Straddle Strategy

Strategy Overview:

A short straddle involves selling both a call option and a put option at the same strike price and expiration date. This strategy profits when the underlying stock remains near the strike price, allowing both options to expire worthless.

Investor Outlook:

Short straddles are implemented when traders expect low volatility and sideways price movement. This strategy benefits from time decay and decreasing implied volatility but carries significant risk if the stock moves substantially.

Risks and Rewards:

- Maximum Profit: Limited to total premium received from selling both options

- Maximum Loss: Theoretically unlimited if stock moves significantly

- Break-even Points: Strike price ± total premium received

- Risk Profile: Limited upside, unlimited downside risk

Video Tutorial: Straddles Explained (Long and Short)

Master both long and short straddle strategies, including when to use each approach and how volatility impacts profitability.

Long Strangle Strategy

Strategy Overview:

A long strangle involves buying a call option and a put option with different strike prices but the same expiration date. Typically, the call strike is above current stock price and the put strike is below, creating a wider profit zone than a straddle.

Investor Outlook:

Long strangles are used when traders expect significant volatility but want to reduce the cost compared to a straddle. This strategy requires larger price movements to be profitable but costs less to implement.

Risks and Rewards:

- Maximum Profit: Theoretically unlimited (stock moves beyond either strike)

- Maximum Loss: Limited to total premium paid for both options

- Break-even Points: Call strike + total premium, Put strike – total premium

- Risk Profile: Lower cost than straddles but requires larger moves

Short Strangle Strategy

Strategy Overview:

A short strangle involves selling a call option above current stock price and a put option below current stock price, both with the same expiration. This strategy profits when the stock stays between the two strike prices.

Investor Outlook:

Short strangles are implemented when traders expect low to moderate volatility and range-bound price action. This strategy collects premium from both options but requires careful risk management due to unlimited loss potential.

Risks and Rewards:

- Maximum Profit: Limited to total premium received from selling both options

- Maximum Loss: Theoretically unlimited if stock moves beyond strikes

- Break-even Points: Call strike + total premium, Put strike – total premium

- Risk Profile: Income-generating but high-risk strategy

Covered Call Strategy

Strategy Overview:

A covered call involves owning 100 shares of stock while selling a call option against those shares. This conservative strategy generates additional income from option premiums while potentially limiting upside if the stock rises above the call strike.

Investor Outlook:

Covered calls are used by investors with a neutral to slightly bullish outlook who want to generate income from their stock holdings. This strategy is popular in retirement accounts and for dividend-focused portfolios.

Risks and Rewards:

- Maximum Profit: (Call Strike – Stock Purchase Price) + Call Premium

- Maximum Loss: Stock purchase price – Call premium (if stock goes to zero)

- Break-even Point: Stock purchase price – call premium received

- Risk Profile: Conservative income strategy with limited upside

Video Tutorial: Covered Calls Explained

Learn how to implement covered calls for income generation, strike selection strategies, and when to roll or close positions.

Protective Put Strategy

Strategy Overview:

A protective put involves owning 100 shares of stock while buying a put option to protect against downside risk. This strategy acts as “portfolio insurance,” limiting losses while maintaining unlimited upside potential.

Investor Outlook:

Protective puts are used by investors who are bullish long-term but want protection against short-term declines. This strategy is popular before earnings announcements or during uncertain market conditions.

Risks and Rewards:

- Maximum Profit: Theoretically unlimited (stock can rise indefinitely)

- Maximum Loss: (Stock Purchase Price – Put Strike) + Put Premium

- Break-even Point: Stock purchase price + put premium paid

- Risk Profile: Defensive strategy with insurance-like protection

Video Tutorial: Protective Puts Explained

Understand how protective puts work as portfolio insurance, cost considerations, and optimal strike selection for downside protection.

Key Concepts & Advanced Considerations:

When using this option strategy builder, consider these critical factors:

- Model Assumptions: Calculations use the Black-Scholes framework, which assumes European-style exercise and constant volatility across strikes.

- Implied Volatility Impact: Changes in implied volatility can significantly affect strategy profitability, especially for straddles and strangles.

- Time Decay (Theta): All strategies are affected by time decay, with short-premium strategies benefiting and long-premium strategies suffering from passage of time. Learn more about time decay with my Options Greeks Calculator.

- Assignment Risk: Short option positions carry assignment risk, requiring adequate capital and risk management protocols.

- Liquidity Considerations: Ensure adequate bid-ask spreads and volume for efficient strategy execution and exit.

- Commission Impact: Multi-leg strategies involve higher transaction costs that can impact overall profitability.

Practical Applications & Strategy Selection:

Choose the optimal strategy based on your market outlook:

- Bullish Outlook: Bull call spreads, covered calls, or protective puts

- Bearish Outlook: Bear put spreads or protective puts on short positions

- High Volatility Expected: Long straddles or strangles

- Low Volatility Expected: Short straddles, strangles, or covered calls

- Income Generation: Covered calls or cash-secured puts

- Portfolio Protection: Protective puts or collar strategies

This option strategy calculator provides comprehensive analysis for sophisticated options trading, but should be combined with fundamental analysis, technical analysis, and proper risk management. Remember that all options trading involves substantial risk and may not be suitable for all investors.

See my preferred options broker IBKR here.

Save on Top Finance Tools & Services

Get exclusive savings on essential CFA prep courses, market data feeds, stock research platforms, brokerage services, and more through our partnerships.