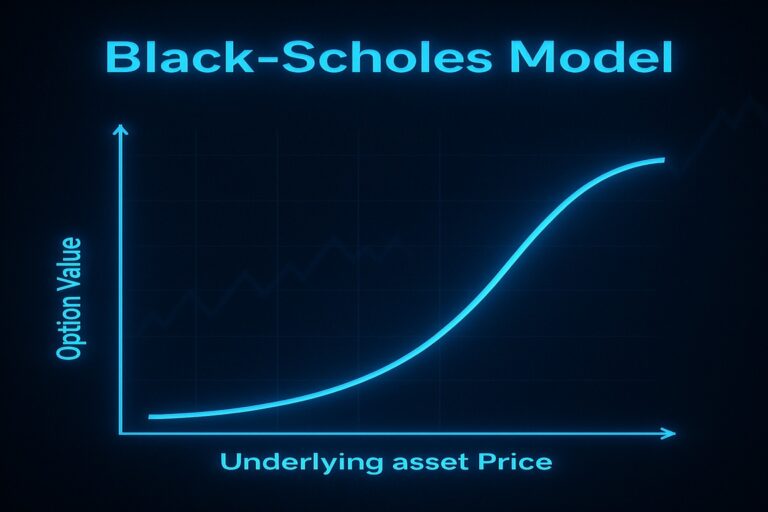

Black Scholes Calculator

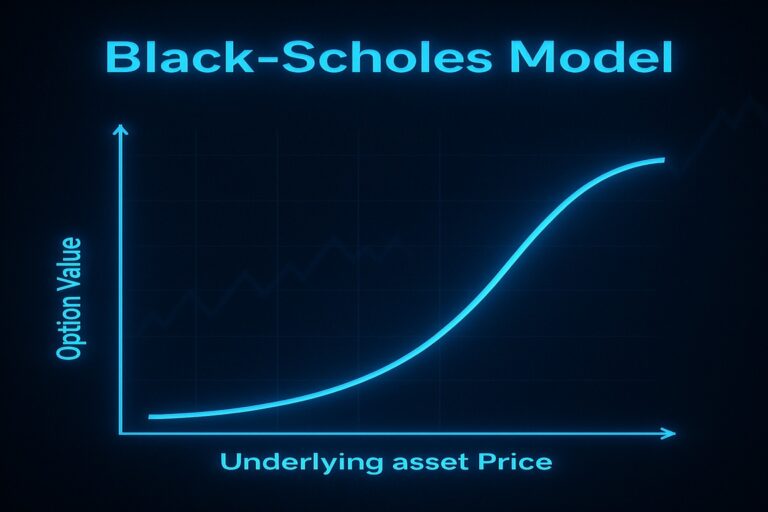

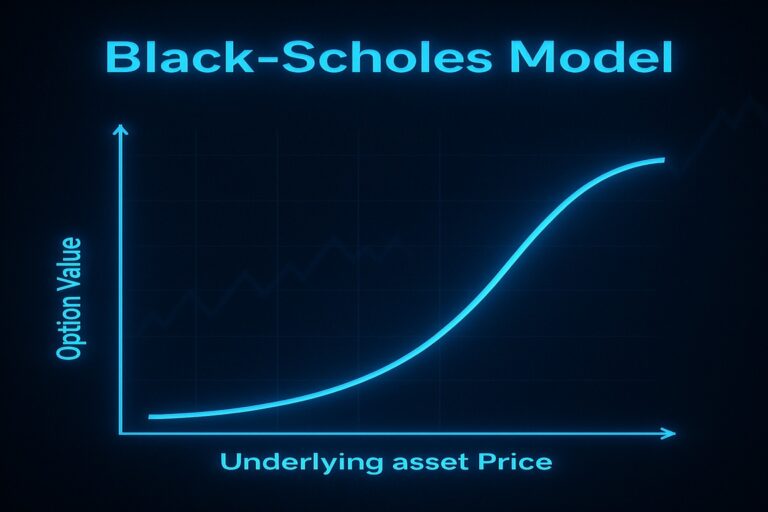

Estimate the theoretical price of European call and put options using this Black Scholes Calculator....

Access powerful tools for options pricing, investment analysis, and financial planning. Professional-grade calculators with no signup required.

Estimate the theoretical price of European call and put options using this Black Scholes Calculator....

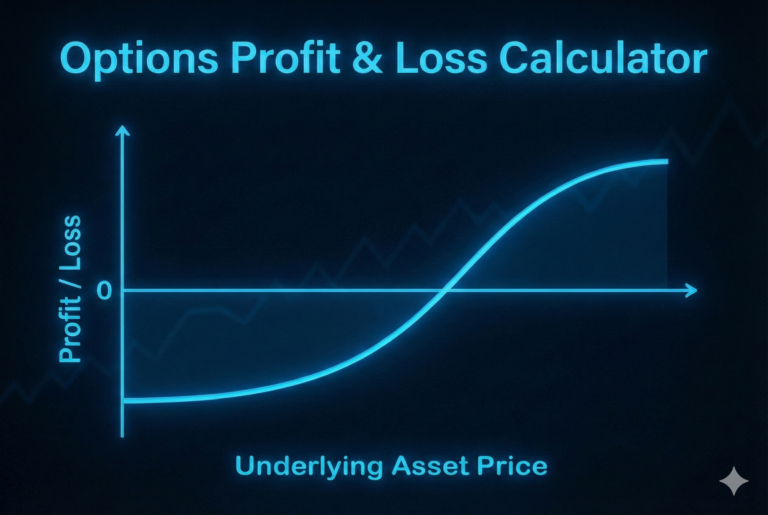

Visualize potential profit and loss for any options strategy. Add multiple legs, view expiration curves,...

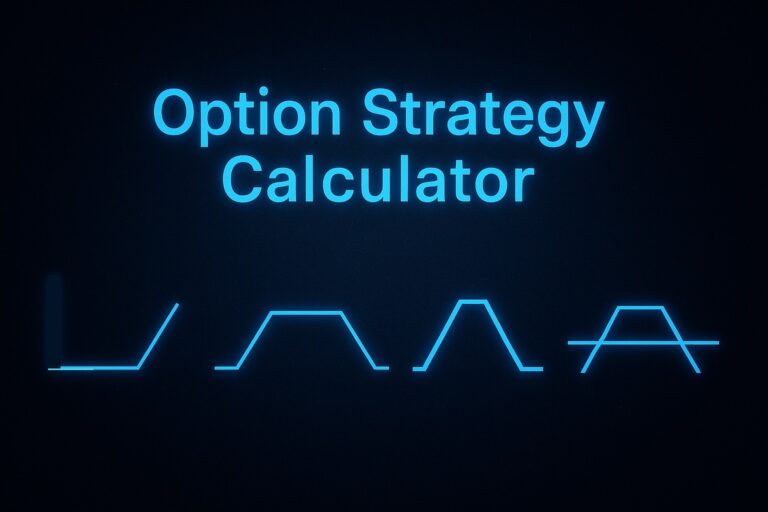

Build and analyze complex option strategies with this comprehensive option strategy calculator. Input market parameters,...

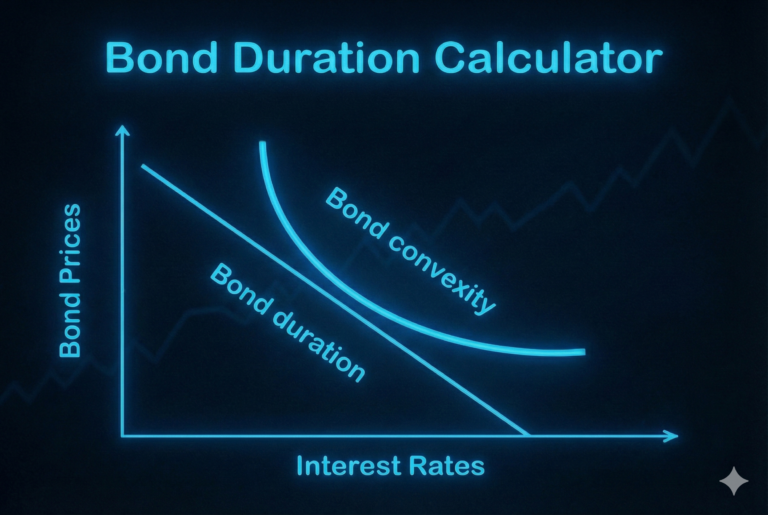

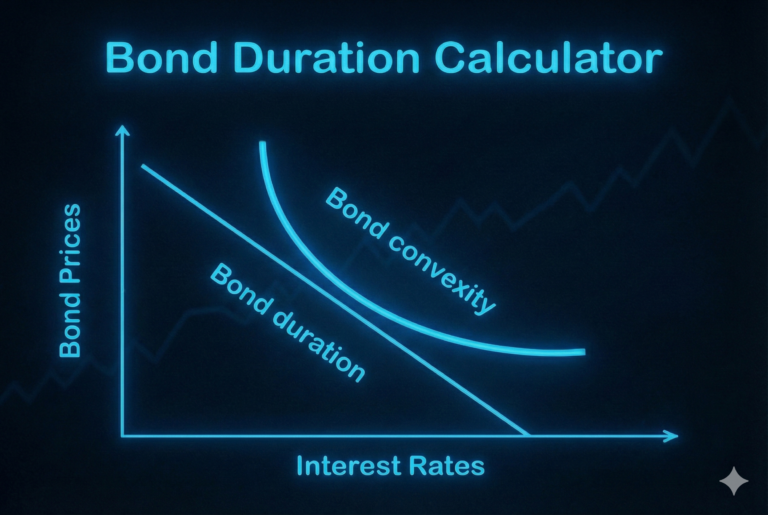

Instantly compute bond price, Macaulay duration, modified duration, DV01, convexity, and interest-rate sensitivity in seconds.

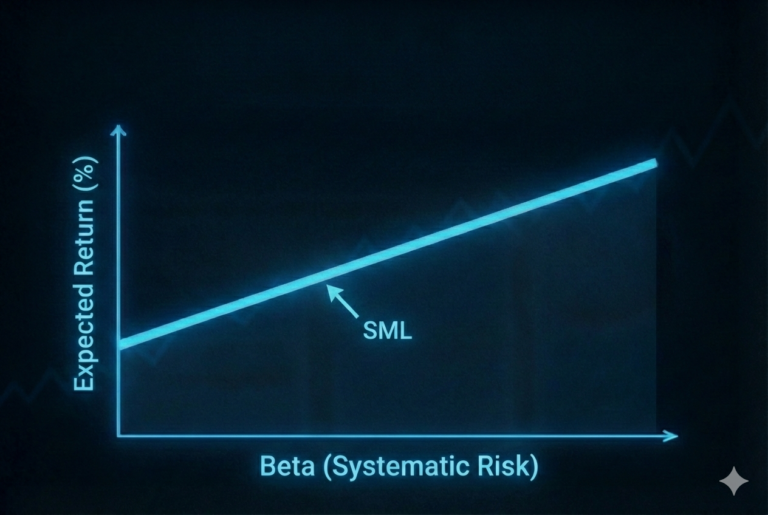

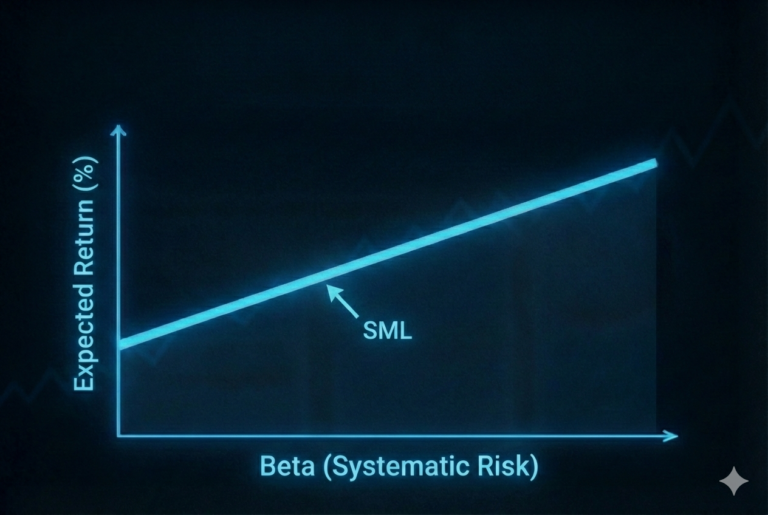

Calculate expected return using the Capital Asset Pricing Model. Determine required return based on beta...

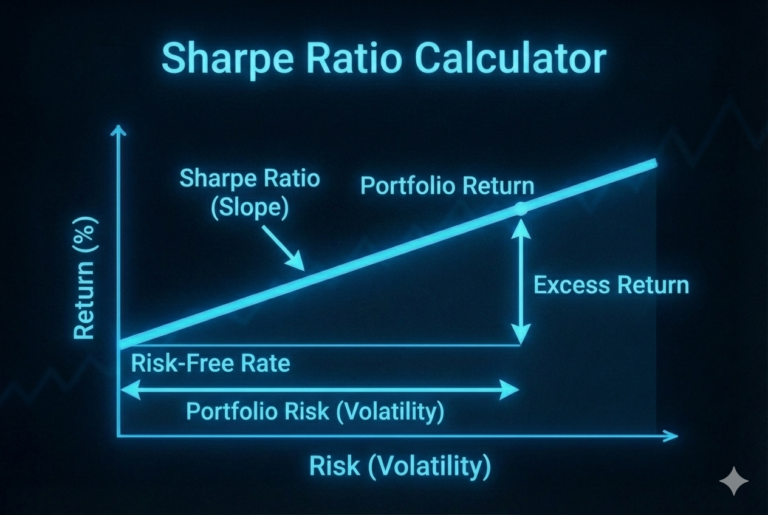

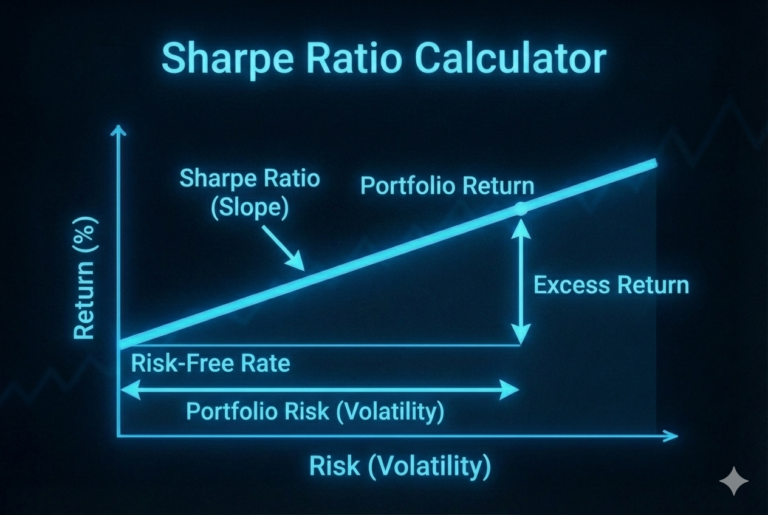

Measure risk-adjusted returns by comparing excess return to volatility. The industry standard for portfolio performance...

Free Options calculators for financial analysis and planning.

Decompose any option price into intrinsic and extrinsic (time) value. Visualize how moneyness, time decay,...

Estimate the theoretical price of European call and put options using this Black Scholes Calculator....

Free Portfolio Management calculators for financial analysis and planning.

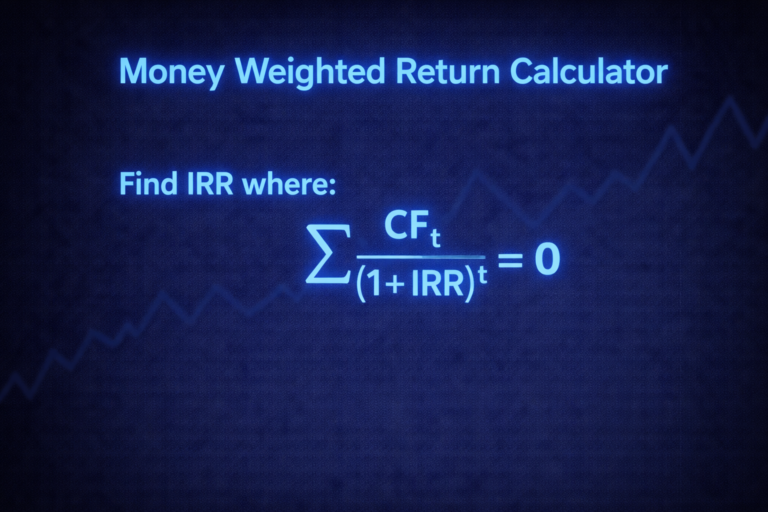

Calculate your personal rate of return (IRR) that accounts for the timing and size of...

Measure risk-adjusted returns by comparing excess return to volatility. The industry standard for portfolio performance...

Calculate expected return using the Capital Asset Pricing Model. Determine required return based on beta...

Free Derivatives calculators for financial analysis and planning.

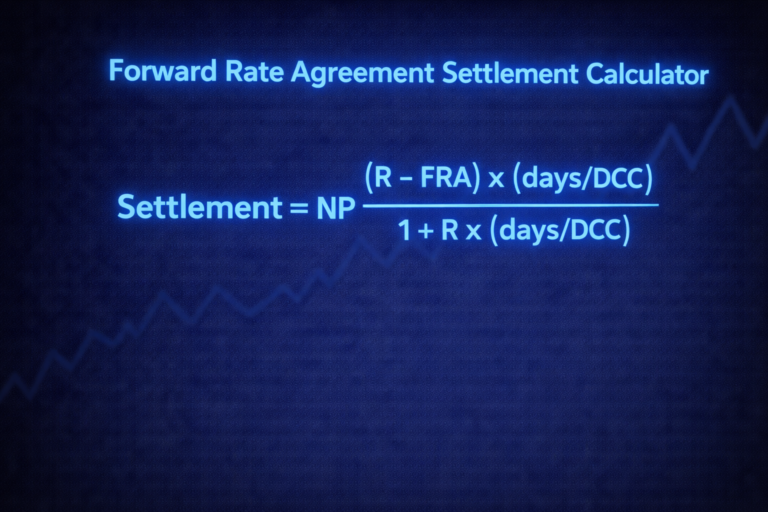

Calculate Forward Rate Agreement settlement amounts. Determine cash flows for FRA hedging and interest rate...

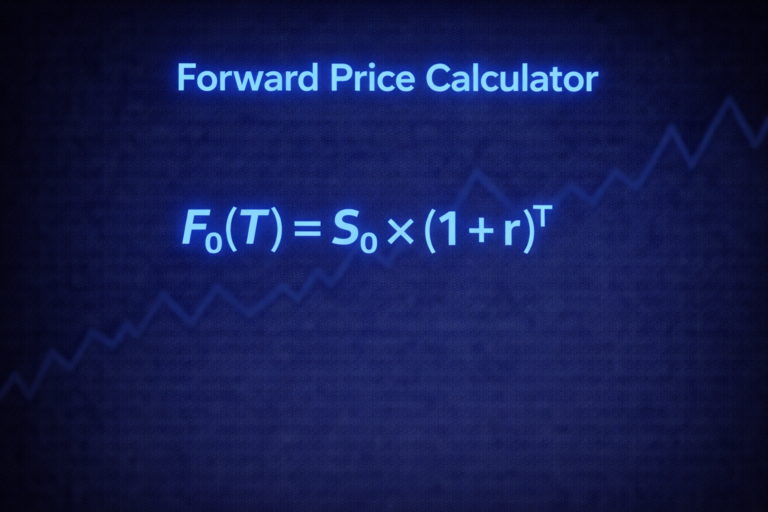

Calculate forward contract prices using spot price, risk-free rate, and time to expiration. Essential for...

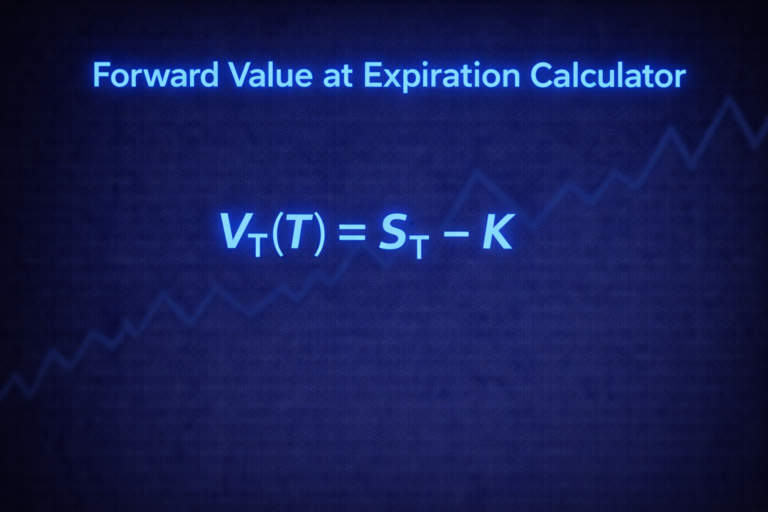

Determine the value of a forward contract at expiration. Compare forward price to spot price...

Free Equities calculators for financial analysis and planning.

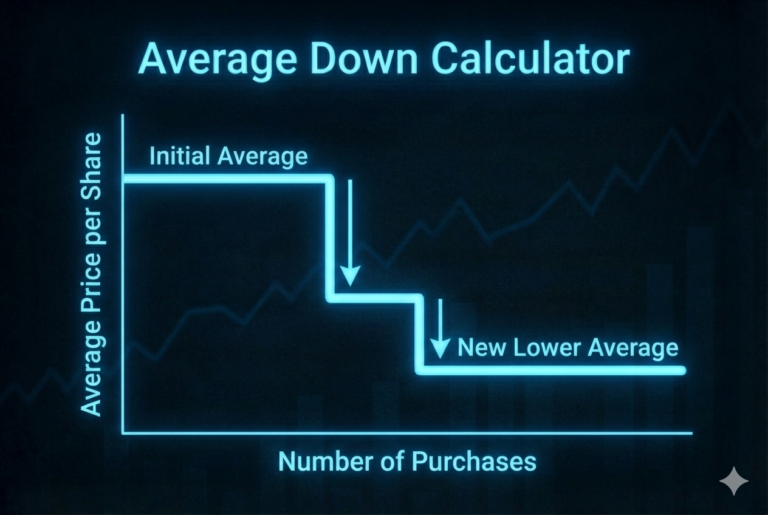

Calculate your average cost basis when adding to positions. Track weighted average price across multiple...

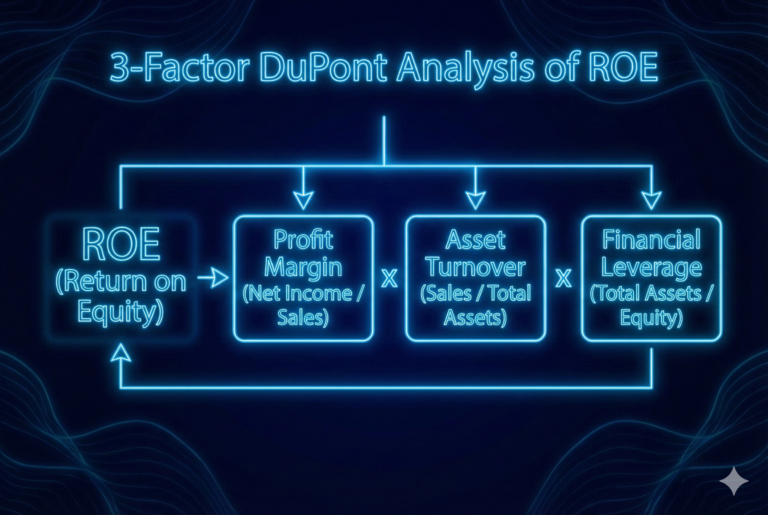

Break down Return on Equity (ROE) into component factors using 3-factor or 5-factor DuPont Analysis....

Calculate the fair value of a stock with constant dividend growth using the Gordon Growth...

Free Fixed Income calculators for financial analysis and planning.

Instantly compute bond price, Macaulay duration, modified duration, DV01, convexity, and interest-rate sensitivity in seconds.

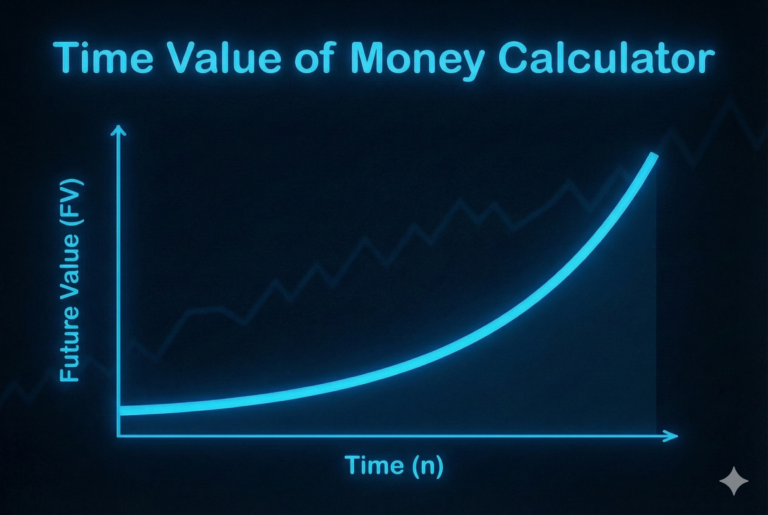

Solve for N, I/Y, PV, PMT, or FV to model loans, savings, and investments fast.

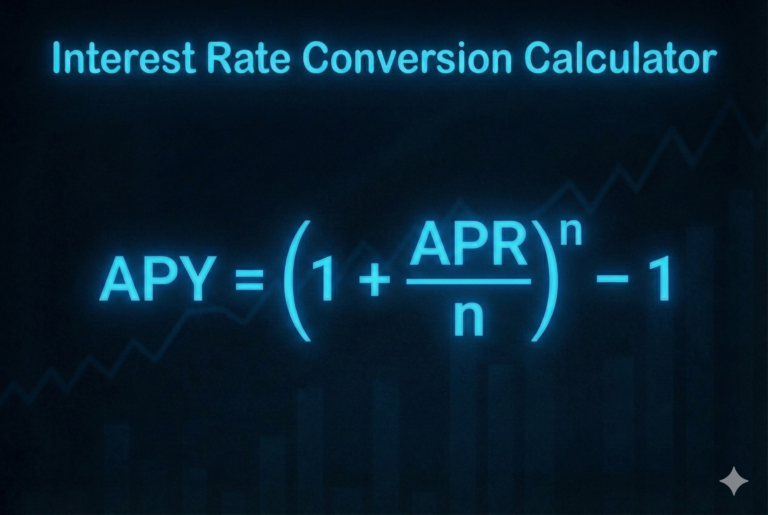

Convert between APR, APY, and periodic rates instantly. Supports monthly, quarterly, semi-annual, and continuous compounding.

Free Corporate Finance calculators for financial analysis and planning.

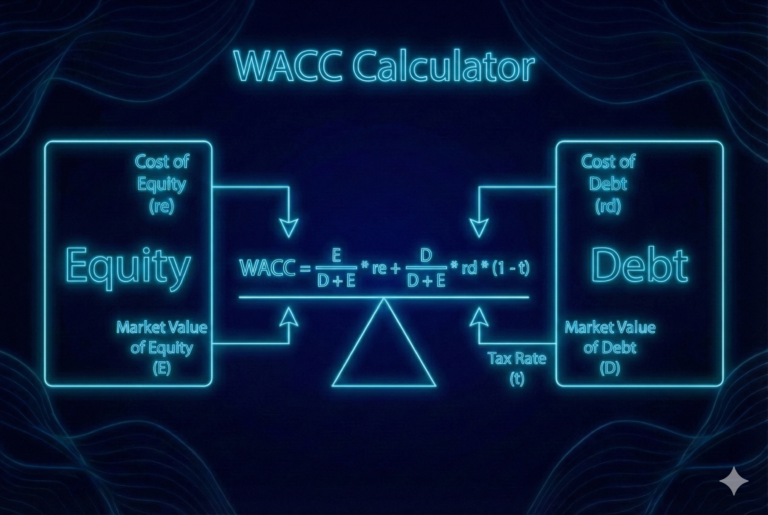

Calculate the Weighted Average Cost of Capital for a company. Essential for DCF analysis and...

Calculate Net Present Value (NPV), IRR, profitability index, and payback period for investments. Free NPV...

Free Real Estate calculators for financial analysis and planning.

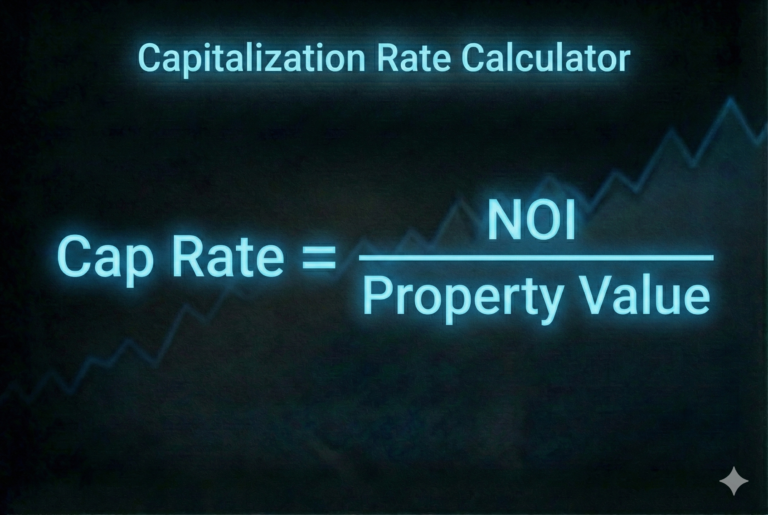

Calculate capitalization rate, property value, or required NOI for real estate investments. Understand Net Operating...

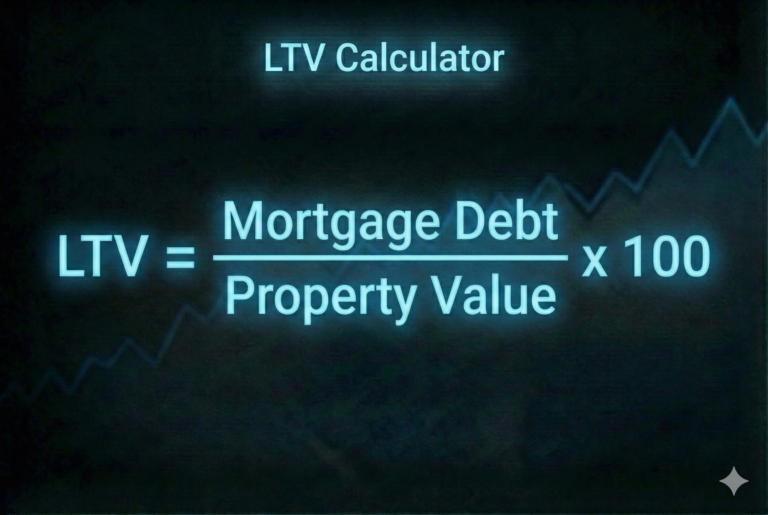

Calculate loan-to-value ratio, maximum loan amount, and equity position. Essential for mortgage qualification, PMI analysis,...

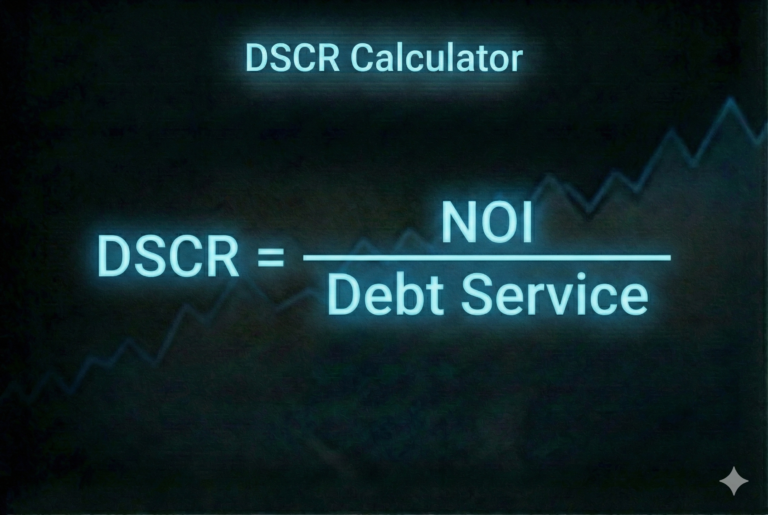

Calculate debt service coverage ratio, maximum debt service, or required NOI. Essential metric for commercial...

Have a suggestion for a new calculator? I'd love to hear from you.