Implied Volatility Calculator

Calculate the implied volatility of options using market prices with this comprehensive implied volatility calculator. Input current stock price, strike price, market option price, time to expiration, and risk-free rate to determine what volatility the market is pricing into the option.

Video Tutorial: Option Implied Volatility Explained + How to Calculate It in Excel

Watch this detailed Excel tutorial to understand implied volatility concepts and learn how to calculate it step-by-step using Excel for real-world options trading applications.

Calculate Implied Volatility from Option Market Prices

Implied volatility represents the market’s expectation of how much the underlying stock price will fluctuate over the life of an option. Unlike historical volatility, which looks backward at past price movements, implied volatility is forward-looking and derived from current option market prices. This implied volatility calculator uses the Black-Scholes model and advanced numerical methods to reverse-engineer the volatility assumption embedded in option prices.

What This Calculator Provides:

This tool calculates the implied volatility for:

- European Call Options: Determines what volatility assumption is built into the current market price of call options.

- European Put Options: Calculates the implied volatility from current put option market prices.

Understanding implied volatility is crucial for options traders as it helps identify overvalued or undervalued options, assess market sentiment, and develop sophisticated trading strategies like volatility trading.

How to Use the Implied Volatility Calculator:

- Select Option Type: Choose whether you’re analyzing a call option or put option.

- Enter Current Stock Price (S): The current market price of the underlying asset.

- Enter Strike Price (K): The strike price of the option contract.

- Enter Days to Expiration: The number of calendar days remaining until the option expires.

- Enter Risk-Free Interest Rate (%): The current annualized risk-free rate (typically the Treasury bill rate).

- Enter Theoretical Price ($): The current market price of the option you’re analyzing.

- Enter Dividend Yield (%): The expected annualized dividend yield of the underlying stock (enter 0 if no dividends).

- View Results: The calculated implied volatility will be displayed as a percentage.

Understanding Implied Volatility:

Implied volatility is one of the most important concepts in options trading and serves several key purposes:

- Market Sentiment Gauge: High implied volatility often indicates market uncertainty or expected significant price movements, while low implied volatility suggests market calm.

- Options Valuation: Helps determine if options are relatively expensive or cheap compared to historical norms.

- Strategy Selection: Influences whether to use strategies that benefit from high volatility (like straddles) or low volatility (like covered calls).

- Risk Assessment: Provides insight into the market’s perception of potential price swings in the underlying asset.

Key Concepts & Considerations:

When using this implied volatility calculator, keep these important factors in mind:

- Volatility Smile/Skew: Implied volatility often varies across different strike prices and expiration dates, creating patterns known as volatility smile or skew.

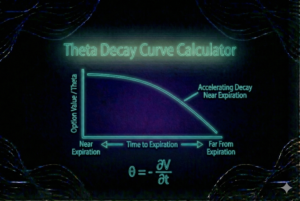

- Time Decay Impact: As options approach expiration, time decay becomes more significant and can affect implied volatility calculations.

- Market Efficiency: The calculator assumes market prices reflect fair value, but bid-ask spreads and liquidity can impact accuracy.

- Model Limitations: Based on the Black-Scholes framework, which has assumptions about constant volatility and European-style exercise.

- Historical Context: Compare current implied volatility to historical ranges to assess if options are relatively expensive or cheap.

Practical Applications:

Traders and investors use implied volatility analysis for various strategies:

- Volatility Trading: Buy options when implied volatility is low and sell when it’s high.

- Earnings Plays: Analyze how earnings announcements affect implied volatility levels.

- Risk Management: Assess portfolio exposure to volatility changes and potential vega risk.

- Strategy Optimization: Choose the most appropriate options strategies based on current volatility environment.

This calculator provides the foundation for sophisticated options analysis, but should be used alongside other tools and market analysis. Remember that implied volatility is just one factor in options pricing and trading decisions.

See my preferred options broker IBKR here.

See my implied volatility calculator in Excel here.

Save on Top Finance Tools & Services

Get exclusive savings on essential CFA prep courses, market data feeds, stock research platforms, brokerage services, and more through our partnerships.