Estimating Beta of a Stock in Excel – An Interactive Excel File

Price range: $0.00 through $20.00

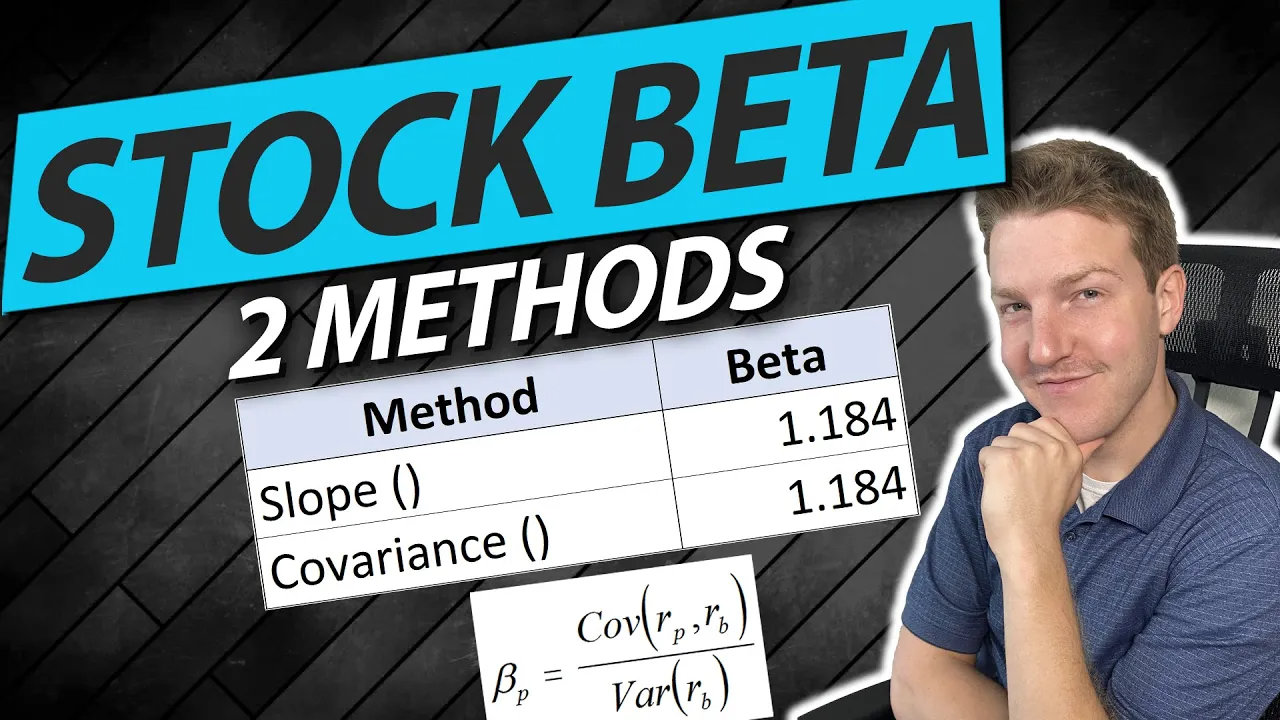

The “Estimating Beta of a Stock in Excel” file is a comprehensive, user-friendly tool designed to educate users on calculating the beta of a stock, reflecting its volatility in relation to the market. This interactive Excel file elucidates the process of downloading stock price data from Yahoo Finance, computing daily stock price returns, and estimating the beta of a stock using Excel’s =SLOPE() and =COVARIANCE.P() functions. Ideal for self-learners and budding financial analysts, this tool offers a hands-on approach to enhancing your financial analytical skills while cautioning that it is not a source of financial advice but a learning aid.

Description

Are you interested in learning how to estimate the beta of a stock? If so, then this practical and user-friendly Excel file is perfect for you. The file is meticulously designed and inspired by Ryan O’Connell, CFA, FRM’s instructional video “How to Estimate the Beta of a Stock in Excel.”

Features:

- Stock Price Data Retrieval: This Excel file will guide you on how to download stock price data from Yahoo Finance, which is essential for beta calculation.

- Daily Stock Price Returns Calculation: Gain an understanding of how to calculate daily stock price returns, an integral step for beta estimation.

- Beta Estimation Using SLOPE: Learn to estimate the beta of a stock using Excel’s

=SLOPE()function, which enables you to gain insight into a stock’s volatility in relation to the market. - Beta Estimation Using COVARIANCE.P: Acquire knowledge about estimating the beta of a stock using Excel’s

=COVARIANCE.P()function. This provides another angle from which to approach beta estimation, reinforcing your comprehension.

This Excel file is an excellent self-learning tool for those wishing to expand their financial analysis skills, particularly when dealing with stock risk management. It’s interactive, easy to follow, and allows you to apply the concepts as you learn. It’s like having Ryan O’Connell as your personal tutor in Excel!

Please note that this tool does not constitute financial advice. It’s an educational resource aimed at enhancing your financial analytical skills.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|