Implied Volatility Excel Calculator

$0.00 – $20.00Price range: $0.00 through $20.00

Download this free, ready-to-use Implied Volatility Excel Calculator to estimate implied volatility using the Black-Scholes model and Excel Solver. Perfect for traders, students, and finance professionals.

Implied Volatility Excel Calculator

Write your email below to receive our free Stock Portfolio Dashboard start file.

*By submitting my email, I agree to receive news and offers. I can unsubscribe any time.If you don't see it, please check your spam folder.

Description

Easily calculate implied volatility with this Implied Volatility Excel Calculator, designed for traders, investors, and finance students. This free Excel template walks you through using the Black-Scholes option pricing model with built-in formulas and Solver integration to estimate implied volatility based on market data.

No coding or advanced Excel skills required — just input your option data and follow the step-by-step instructions included. Ideal for anyone learning options trading, option pricing, or financial modeling.

👉 Download your Implied Volatility Excel Calculator today and start applying professional analysis techniques in minutes.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|

Related products

-

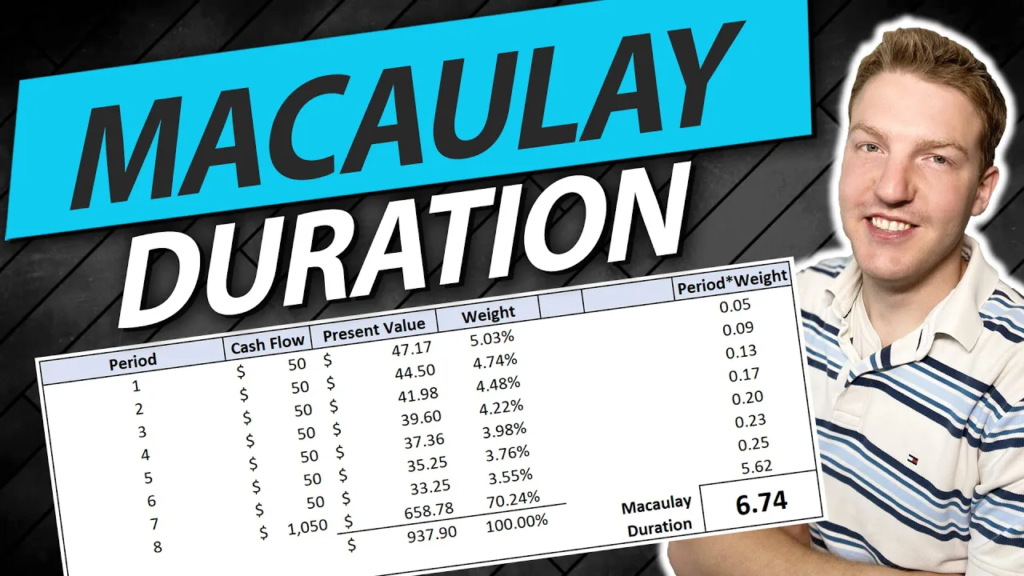

Macaulay Bond Duration Excel Template

$0.00 – $20.00Price range: $0.00 through $20.00 Download File This product has multiple variants. The options may be chosen on the product page -

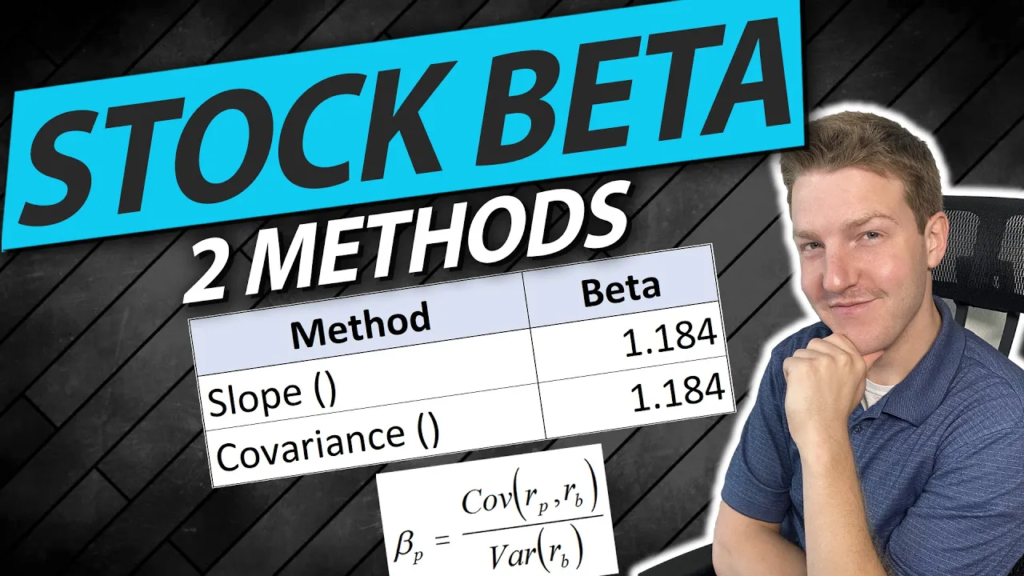

Estimating Beta of a Stock in Excel – An Interactive Excel File

$0.00 – $20.00Price range: $0.00 through $20.00 Download File This product has multiple variants. The options may be chosen on the product page -

Sale!

Black-Scholes & Put-Call Parity Calculator

$10.00Original price was: $10.00.$5.97Current price is: $5.97. Add to cart -

Max Drawdown Calculation Excel Example

$0.00 – $20.00Price range: $0.00 through $20.00 Download File This product has multiple variants. The options may be chosen on the product page