Interest Rate Swaps Excel Model

Price range: $0.00 through $20.00

The Interest Rate Swaps Excel Model is a comprehensive, educational tool designed to explain and demonstrate the valuation of interest rate swaps. This model provides a step-by-step guide to understanding the basics of interest rate swaps, valuing fixed and floating rate payments, and pricing plain vanilla interest rate swaps using Excel Solver. Developed by a seasoned finance professional, this resource offers valuable insights for both beginners and experienced professionals in the field. Please note that this tool is for educational purposes and should not replace professional financial advice!

Description

Discover the art and science of interest rate swaps and how to evaluate them using this comprehensive Excel model developed by Ryan O’Connell, CFA, FRM. Designed for both novices and experienced finance professionals, the model serves as a practical tool to understand and apply the principles of interest rate swap valuation.

Key Features:

- Understanding Interest Rate Swaps: This model starts with a detailed introduction to interest rate swaps. Learn the key concepts and terminology, understand the role of interest rate swaps in risk management and investing.

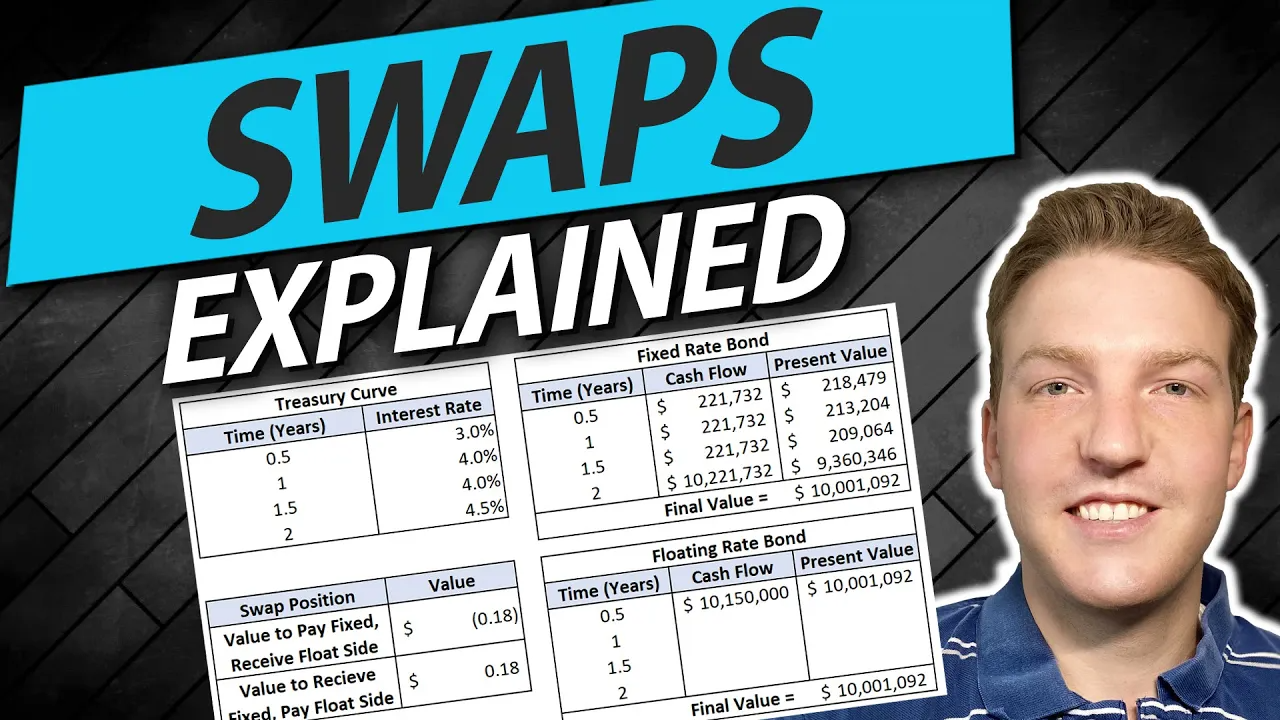

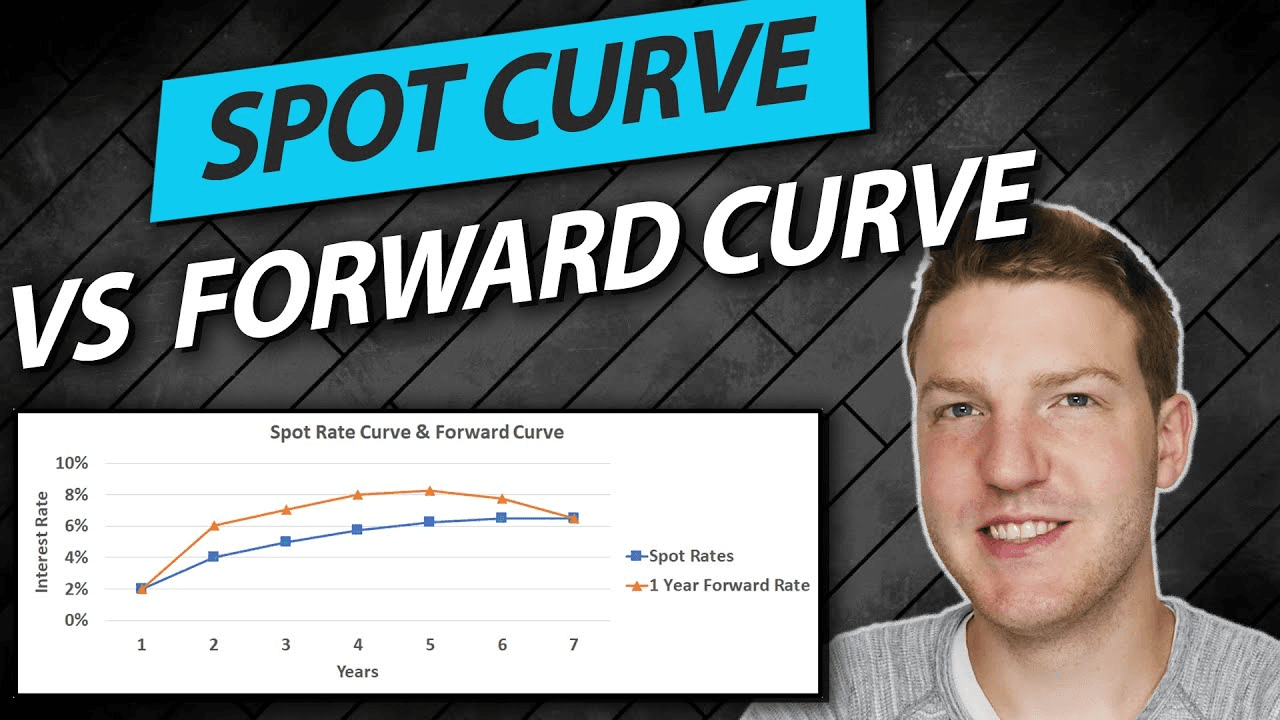

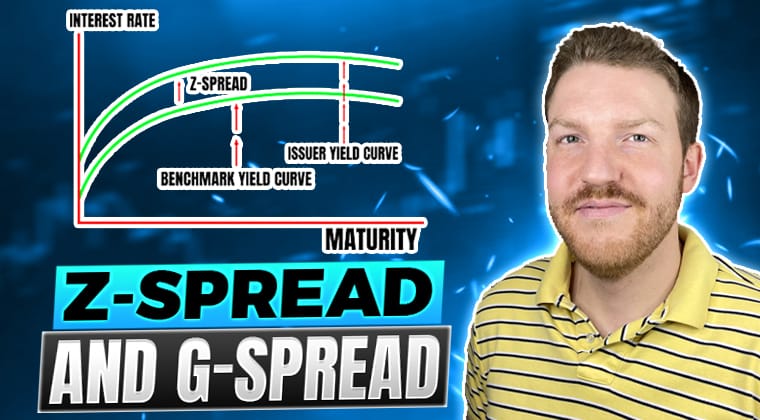

- Swap Basics & The Treasury Curve: Gain a solid understanding of the basic structure of interest rate swaps and how the Treasury curve plays a crucial role in pricing these financial instruments.

- Valuation of Fixed and Floating Rate Payments: The model illustrates how to value a series of fixed-rate payments and floating-rate payments. It offers hands-on examples, showing you the step-by-step calculation process.

- Plain Vanilla Interest Rate Swap Valuation: Dive into the valuation of a plain vanilla interest rate swap, the most common type of interest rate swap. Understand the underlying principles and learn how to perform your own valuations.

- Excel Solver for Interest Rate Swap Pricing: Learn how to leverage Excel Solver to price an interest rate swap. This powerful tool will allow you to solve complex pricing problems efficiently and accurately.

- Designed by an Expert: The model has been developed by Ryan O’Connell, CFA, FRM, an experienced finance professional and educator, ensuring you are learning from a reliable source.

Please note, this is a tool for educational purposes and is not intended to provide financial advice. Users should consult with their own financial advisors before making investment decisions.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|