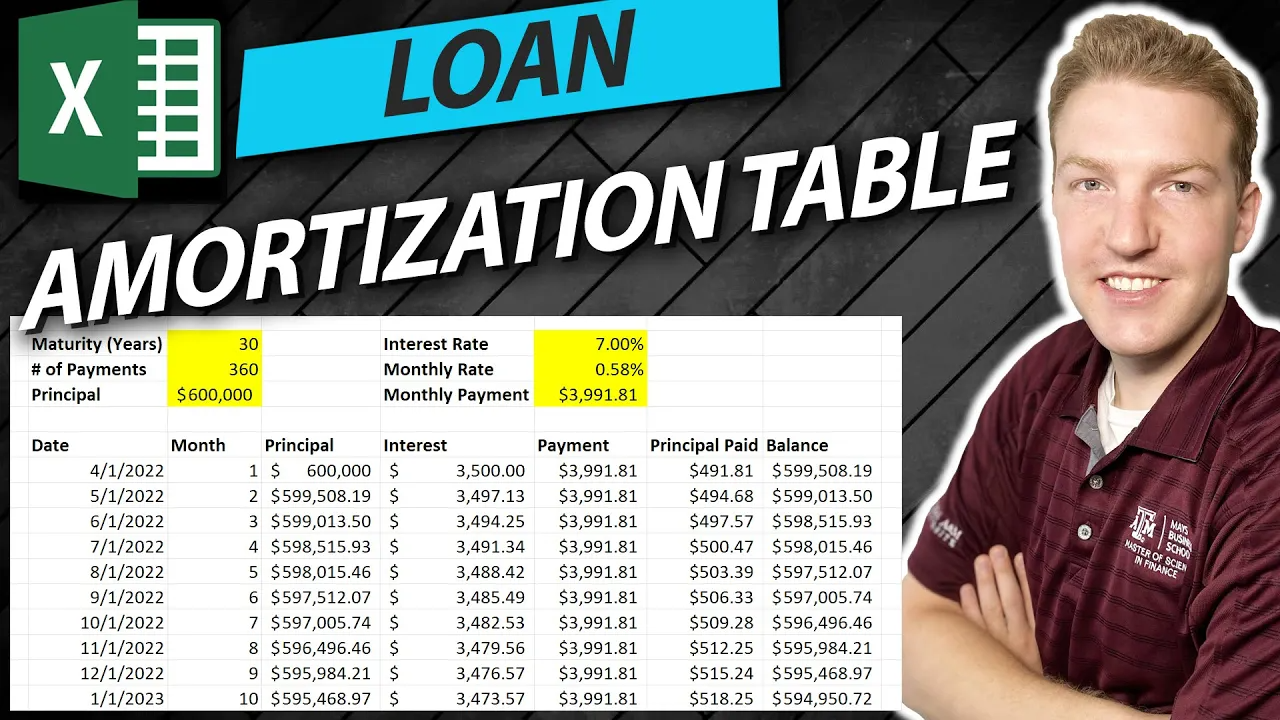

Loan Amortization Table Template in Excel

Price range: $0.00 through $20.00

The Loan Amortization Table Template in Excel is a practical and straightforward tool to help individuals and businesses better understand their loan repayment schedules. With its user-friendly design, this template offers a detailed breakdown of each loan payment, showcasing the proportion dedicated to the principal, interest, and remaining balance. Users can easily customize the table to match their loan conditions, making it a versatile tool for assessing loan timelines and understanding the impact of potential repayment changes. Please note that while this tool provides a comprehensive overview of loan payments, it is not a substitute for professional financial advice!

Description

Effortlessly make sense of your loan repayment schedule with our Loan Amortization Table Template in Excel, developed by financial expert, Ryan O’Connell, CFA, FRM.

This intuitive and user-friendly tool is designed to help individuals, small businesses, or anyone managing loans to understand the intricate details of their loan repayment timeline. The loan amortization table breaks down each payment over the life of the loan, showing exactly how much of each payment is dedicated to the principal, interest, and the remaining balance.

Features:

- Easy to Use: The table is built in Excel, making it universally accessible and easy to modify to your specific loan details. No complex financial software or specialized knowledge is required.

- Fully Customizable: Adapt the table to your specific needs. You can modify loan amounts, interest rates, and payment schedules to mirror your loan conditions.

- Detailed Breakdown: Understand the impact of each payment. This template provides a clear view of how much of your monthly payment goes toward the principal versus the interest.

- Informative Insights: Get a clear sense of your loan timeline, and understand how changes to your repayment plan can affect your financial situation.

Please note that this is a tool designed to help manage and visualize loan payments, but should not be used as a substitute for professional financial advice. It is always advisable to seek the guidance of a certified professional in finance or related fields for personalized financial advice.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|