Optimal Portfolio Calculation Excel Template

Price range: $0.00 through $20.00

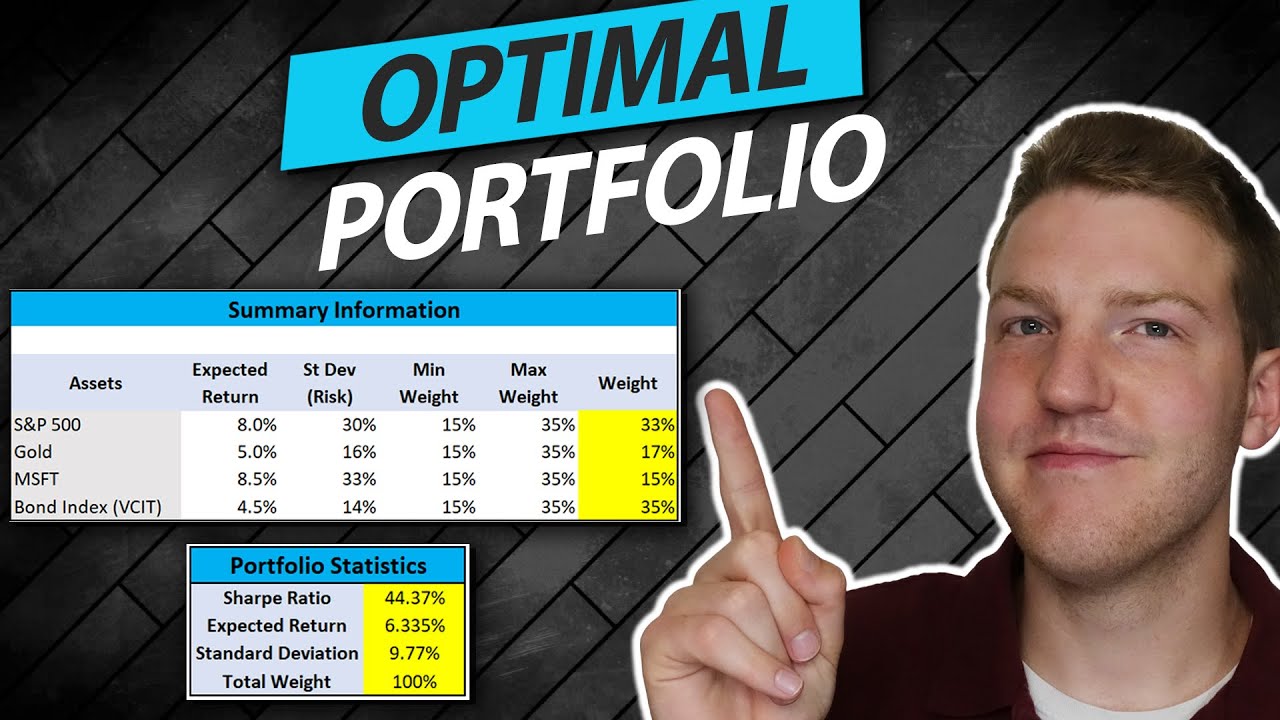

The Optimal Portfolio Calculation Excel Template is a comprehensive, user-friendly tool designed for savvy investors looking to enhance their portfolio management strategy. Built by Ryan O’Connell, CFA FRM, the template leverages the principles of Modern Portfolio Theory and the Efficient Frontier to facilitate strategic investment decisions. It guides users through calculating expected returns, standard deviations, asset weights, creating a covariance matrix, and deriving portfolio standard deviation and Sharpe ratio. Plus, it utilizes Excel Solver to help identify an optimal portfolio mix. Please note, this tool is intended for educational purposes and does not replace professional financial advice.

Description

Product Description:

Take charge of your investment strategies with our Optimal Portfolio Calculation Excel Template, designed to optimize and streamline your portfolio management. Created by Ryan O’Connell, CFA FRM, this Excel template is built upon the principles of the Modern Portfolio Theory (MPT) and the Efficient Frontier, allowing users to strategically align their investments for optimal returns.

Key Features:

- Asset Explanation: Gain a deeper understanding of different asset types and how they contribute to your portfolio.

- Expected Return, Standard Deviation, and Weights: Calculate expected returns, standard deviation, and asset weights with ease to better assess risk and potential rewards.

- Data Analysis and Solver Toolpak: A step-by-step guide on how to enable these essential Excel add-ins for enhanced data analysis.

- Historical Return Data Retrieval: Instructions on how to get historical return data from Yahoo Finance to inform your investment decisions.

- Covariance Matrix: Create a covariance matrix to understand the variability and correlation between different assets in your portfolio.

- Portfolio Standard Deviation and Sharpe Ratio: Understand the risk and potential return of your portfolio by calculating the standard deviation and Sharpe ratio.

- Optimal Portfolio Using Excel Solver: Use the Excel Solver feature to find the optimal portfolio composition based on your investment objectives and risk tolerance.

Download the Optimal Portfolio Calculation Excel Template today to revolutionize your investment strategy, making it more data-driven and effective. Please note that this tool is designed for educational purposes and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Please reach out to roconnellcfa@gmail.com for any business inquiries.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|