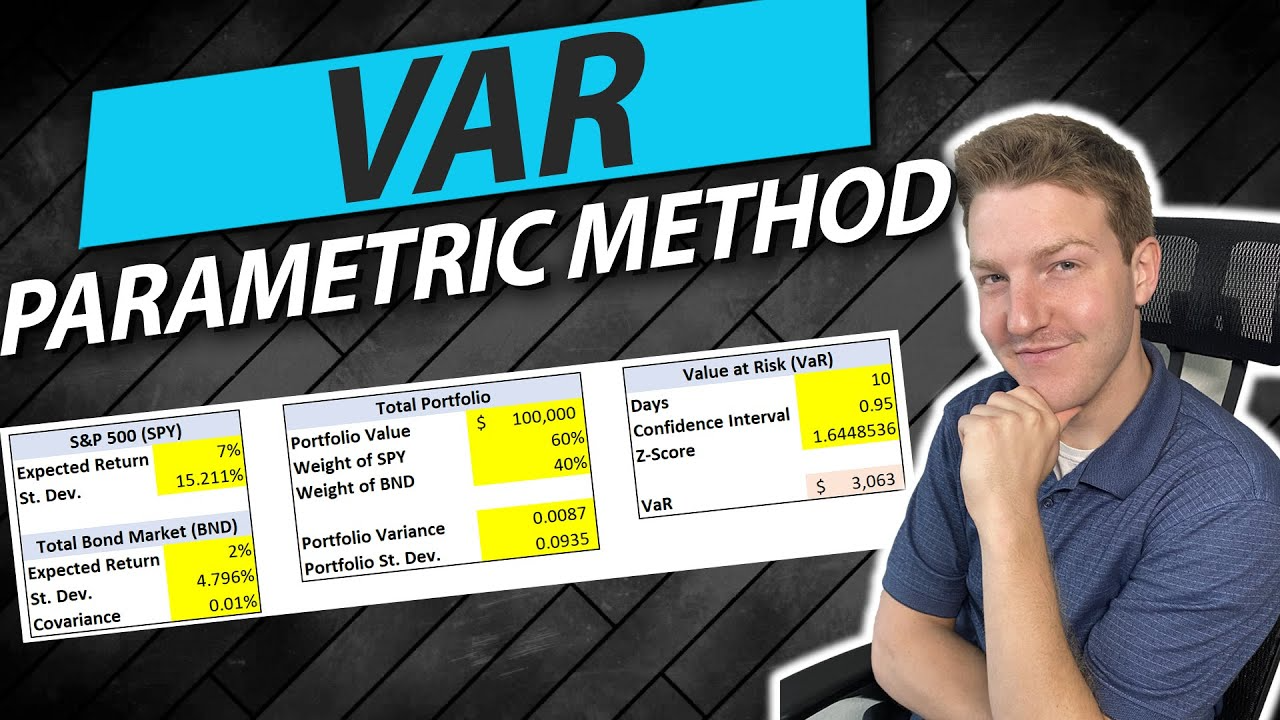

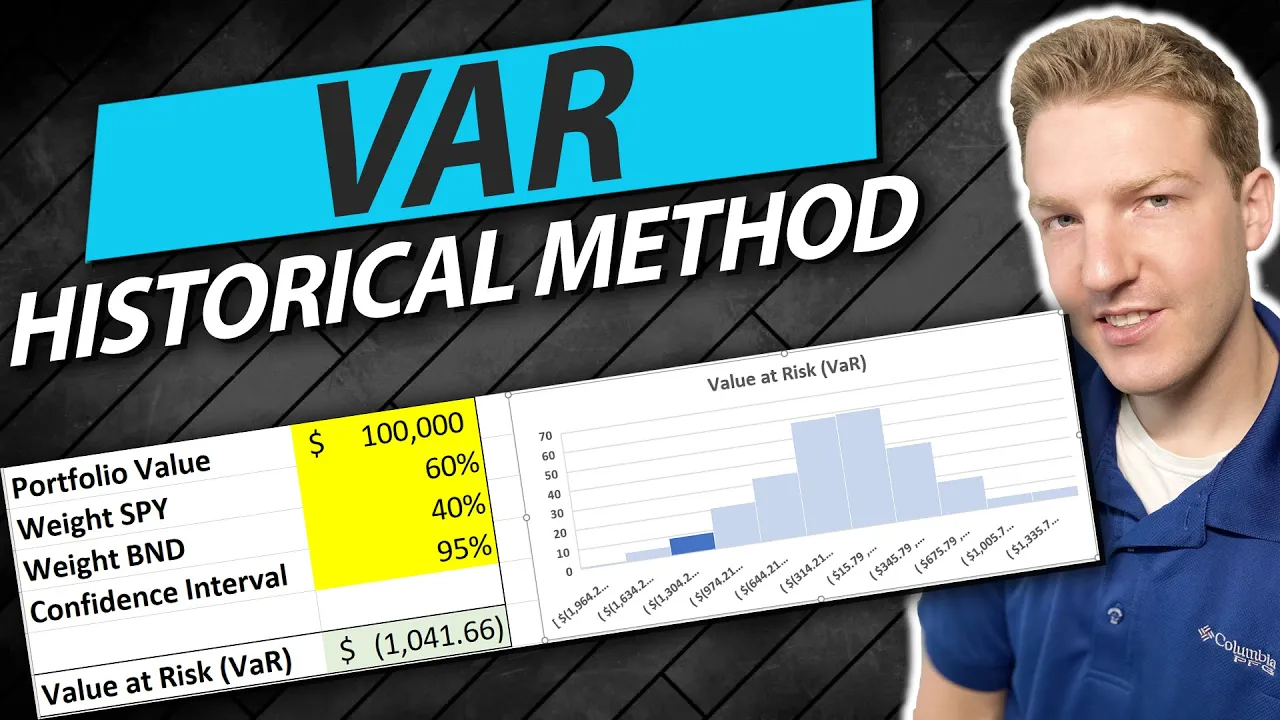

Parametric Method: Value at Risk (VaR) Excel Template

Price range: $0.00 through $20.00

Unleash your risk analysis potential with the Parametric Method: Value at Risk (VaR) Excel Template. This user-friendly template facilitates seamless calculations of daily returns, security standard deviation and covariance, portfolio assumptions, and portfolio variance and standard deviation, culminating in the calculation of Value at Risk (VaR) using the Parametric (Variance-Covariance) Method. While it doesn’t serve as financial advice, this tool is an invaluable asset for finance students, professionals, and enthusiasts, providing deep insights into portfolio risk management. Harness this dynamic resource to enhance your financial decision-making today.

Description

Take the stress out of financial risk analysis with our Parametric Method: Value at Risk (VaR) Excel Template, as demonstrated by Ryan O’Connell, a Certified Financial Analyst (CFA) and Financial Risk Manager (FRM). This comprehensive, easy-to-use Excel spreadsheet is designed to help you calculate the Value at Risk using the Parametric Method, also known as the Variance-Covariance method.

Key Features of the VaR Excel Template:

- Calculate Daily Returns Using Yahoo! Finance: Easily pull in data from Yahoo! Finance and calculate daily returns for your investments.

- Calculate Security Standard Deviation and Covariance: Step-by-step computations allow you to determine the standard deviation and covariance of your securities, crucial metrics for risk management.

- Create Assumptions for Portfolio: This feature allows you to test various assumptions for your portfolio, aiding in planning and decision-making.

- Calculate Variance and Standard Deviation of Portfolio: Gain insight into the risk-reward trade-off in your portfolio with quick calculations of portfolio variance and standard deviation.

- Calculate Value at Risk (VaR) In Excel (Parametric Method): Understand potential losses in your portfolio under normal market conditions and ensure you are prepared for various market scenarios.

Please note, this product does not constitute financial advice but provides an effective tool for you to analyze and manage the risk in your portfolio. It’s ideally suited for finance students, professionals, and anyone interested in understanding the intricacies of risk management in investment portfolios.

Access this dynamic financial tool today, and elevate your approach to portfolio risk management.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|