Protective Puts Excel Model

$0.00 – $20.00

Enhance your trading strategy with our ‘Protective Puts Excel Model’ – a dynamic tool for optimizing your portfolio defense in the options market!

Description

Discover the power of strategic trading with our ‘Protective Puts Excel Model’, a sophisticated yet user-friendly tool designed for both novice and experienced traders. This simple Excel model provides an example of the protective puts strategy. By inputting your own data, you can visualize how protective puts can safeguard your portfolio against downturns, offering a practical approach to risk management. The model includes detailed calculations of payoff structures, making it easier to understand and implement this crucial hedging technique effectively. Whether you’re looking to enhance your understanding of options trading or seeking a reliable method to secure your investments, our ‘Protective Puts Excel Model’ is a valuable resource.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|

Related products

-

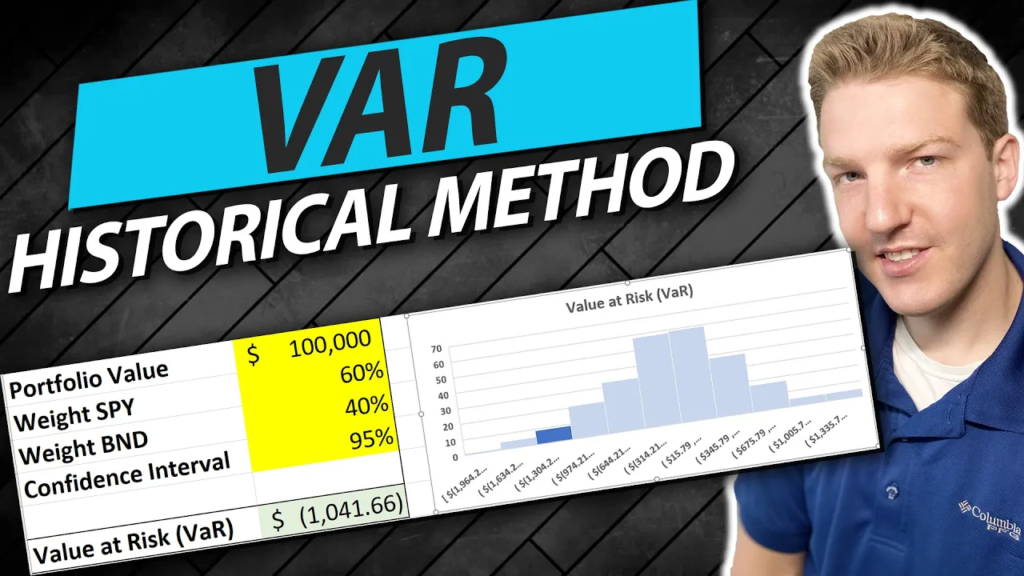

Expected Shortfall & Value at Risk Calculator in Excel

$0.00 – $20.00 Select options -

Value at Risk (VaR) Excel Workbook: A Comprehensive Tool for Risk Management

$0.00 – $20.00 Select options -

Black Scholes Option Pricing Model Excel Workbook

$0.00 – $20.00 Select options -

SOFR Futures Excel Toolkit

$0.00 – $20.00 Select options