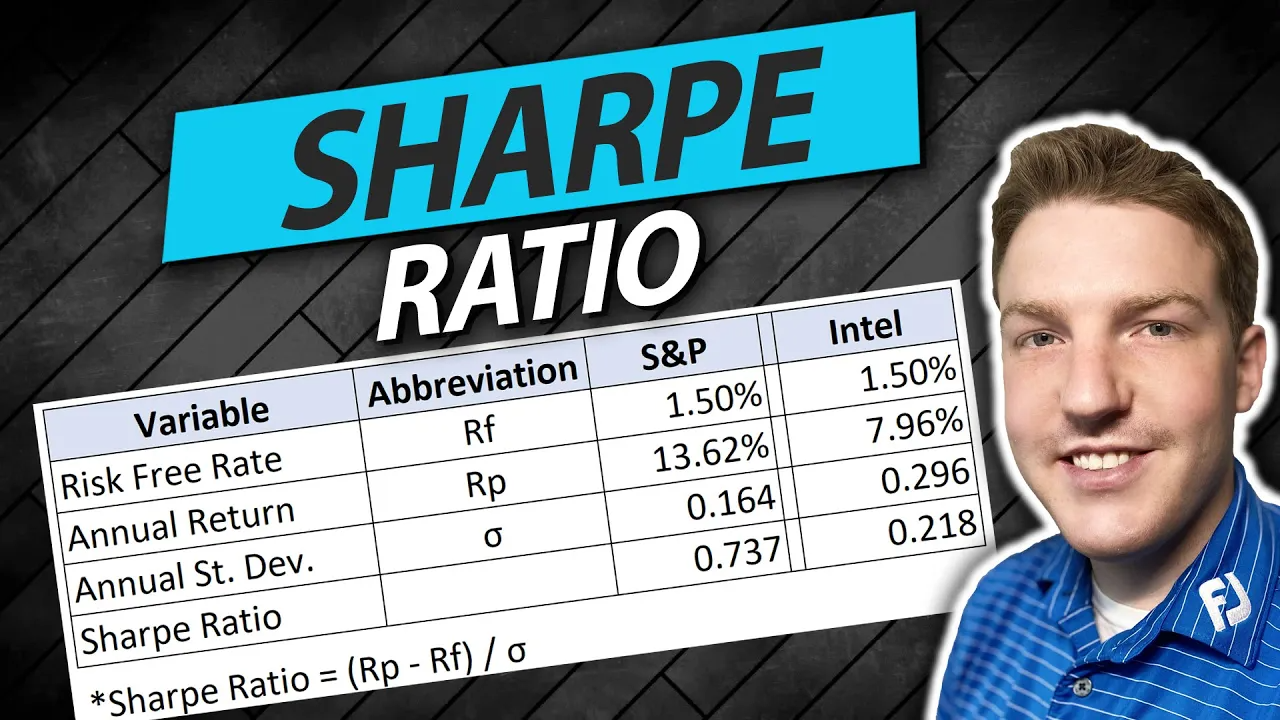

Sharpe Ratio In Excel

Price range: $0.00 through $20.00

Sharpe Ratio In Excel file offered is a comprehensive and user-friendly tool designed to facilitate the calculation of investment performance metrics. With this file, users can import stock price data from Yahoo Finance, calculate daily and annual stock returns, determine the standard deviation of returns, and ultimately calculate the Sharpe Ratio—a key measure of risk-adjusted return. Ideal for investors, financial analysts, and portfolio managers, this free-to-download resource serves as both an educational guide and a practical tool for evaluating investment performance. Note: This does not constitute financial advice and users should consult with a qualified financial advisor for personalized advice.

Description

The Excel file showcased in Ryan O’Connell’s video, “Calculate Sharpe Ratio in Excel,” is a practical tool for individual investors, financial analysts, and portfolio managers looking to measure the performance of a stock or stock portfolio. As a certified Chartered Financial Analyst (CFA) and Financial Risk Manager (FRM), O’Connell uses his expertise to guide users on how to calculate the Sharpe Ratio, a measure widely used to understand the risk-adjusted return of an investment.

Key features of the Excel file include:

- Stock Price Data Import: Users can learn how to import stock price data directly from Yahoo Finance, eliminating manual data entry.

- Daily Stock Price Returns Calculation: The file allows users to calculate daily stock price returns for their selected investment, providing insights into the daily volatility of the investment.

- Annual Returns Calculation: The file includes a methodology to calculate the annual returns of a stock, offering a macro view of investment performance.

- Standard Deviation Calculation: This feature helps users measure the volatility of stock returns, which is a key component in risk assessment.

- Sharpe Ratio Calculation: The highlight of the file, this function allows users to calculate the Sharpe Ratio of a stock or a portfolio, offering insights into risk-adjusted returns.

This file is intended as a learning tool and does not constitute financial advice. It allows users to follow along with the video tutorial and build their financial analysis skills. The file is available for free download, making it a valuable resource for anyone interested in improving their understanding of investment performance evaluation.

Please note: It’s essential to interpret the Sharpe Ratio and other financial measures within the broader context of your investment strategy. For specific advice, consult with a qualified financial advisor.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|