Stock Valuation Excel Spreadsheet Using Dividend Discount Model

Price range: $0.00 through $20.00

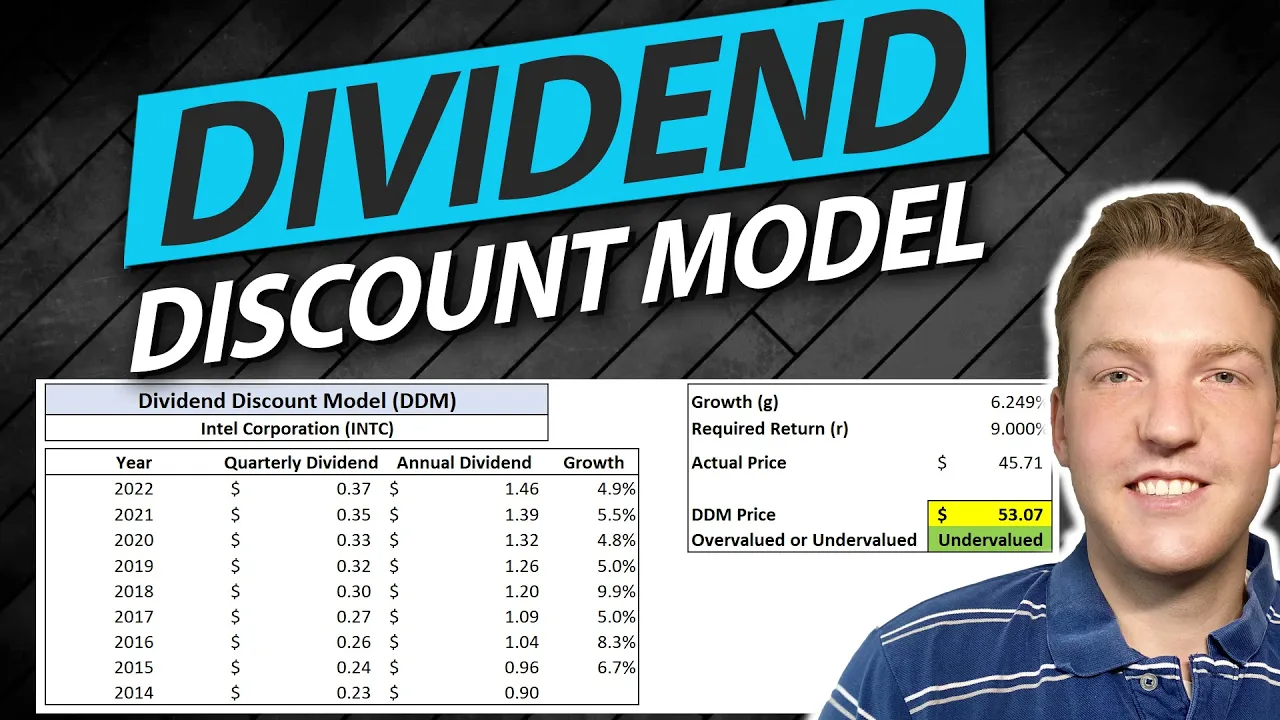

The Stock Valuation Excel Spreadsheet is a powerful tool that enables users to systematically estimate a stock’s value using the Dividend Discount Model (DDM). It integrates functions for automatic data collection from Yahoo Finance, calculates the dividend growth rate and intrinsic stock price, and allows for a clear comparison between calculated and market prices to discern if a stock is overvalued or undervalued. Further, it employs Excel Solver to calculate the required return for investment. Ideal for both financial professionals and investing enthusiasts, this user-friendly, educational tool is freely available for download, bringing informed stock valuation conveniently to your fingertips. Please note, this tool is for informational purposes only and not a source of financial advice.

Description

This Stock Valuation Excel Spreadsheet, designed by certified financial analyst Ryan O’Connell, provides a systematic way to estimate the value of a stock using the Dividend Discount Model (DDM). The spreadsheet facilitates the collection of key data points, such as stock dividend data from Yahoo Finance, and calculates the dividend growth rate and stock price through the DDM.

The power of this tool lies in its flexibility and simplicity of use. With user-friendly interfaces and built-in formulas, this spreadsheet allows both financial professionals and investment enthusiasts to evaluate whether a stock is overvalued or undervalued based on the company’s dividend payouts.

Key Features:

- Data Collection: Automates the downloading of stock dividend data from Yahoo Finance to ensure accurate and up-to-date information for your analysis.

- Dividend Growth Rate Calculation: Provides an inbuilt formula to calculate the Dividend Growth Rate of the stock.

- Stock Price Valuation: Applies the Dividend Discount Model to calculate the intrinsic value of the stock.

- Value Comparison: Evaluates whether the stock is overvalued or undervalued based on the calculated intrinsic value compared to the current market price.

- Required Return Calculation: Employs Excel Solver to compute the required return rate for the stock investment.

Product: Stock Valuation Excel Spreadsheet Using Dividend Discount Model

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|