Value at Risk (VaR) Excel Workbook: A Comprehensive Tool for Risk Management

Price range: $0.00 through $20.00

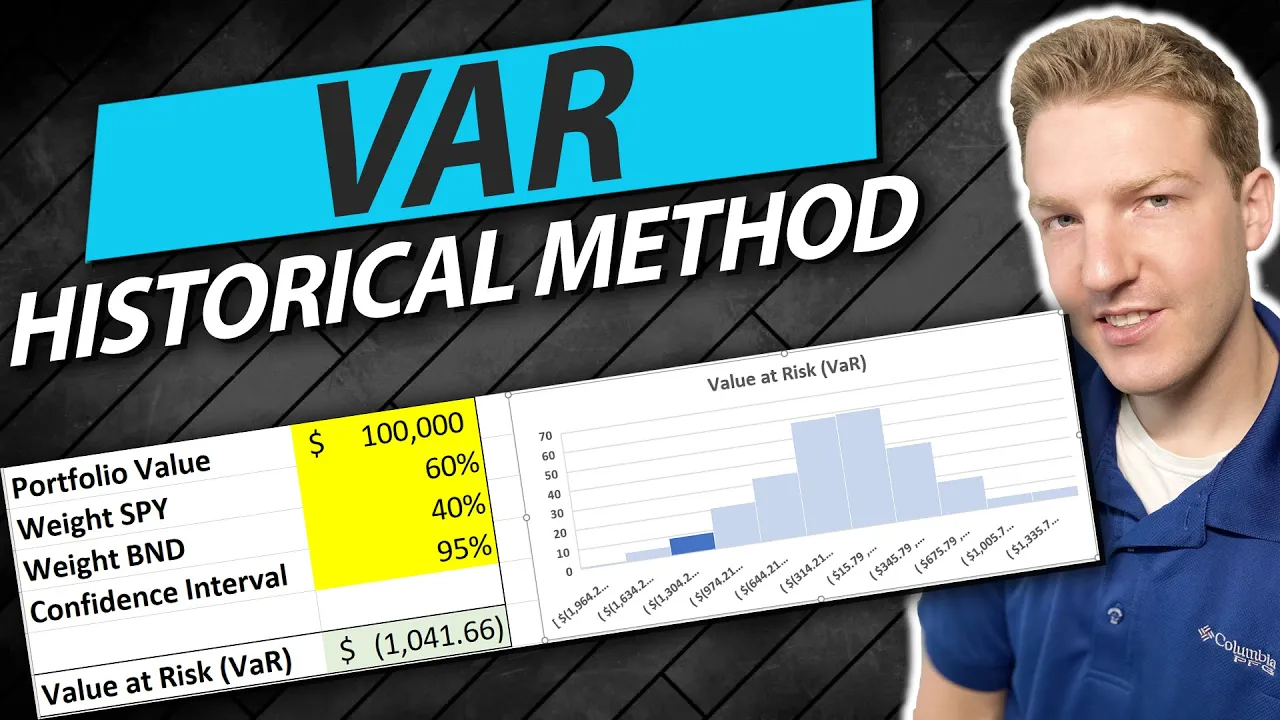

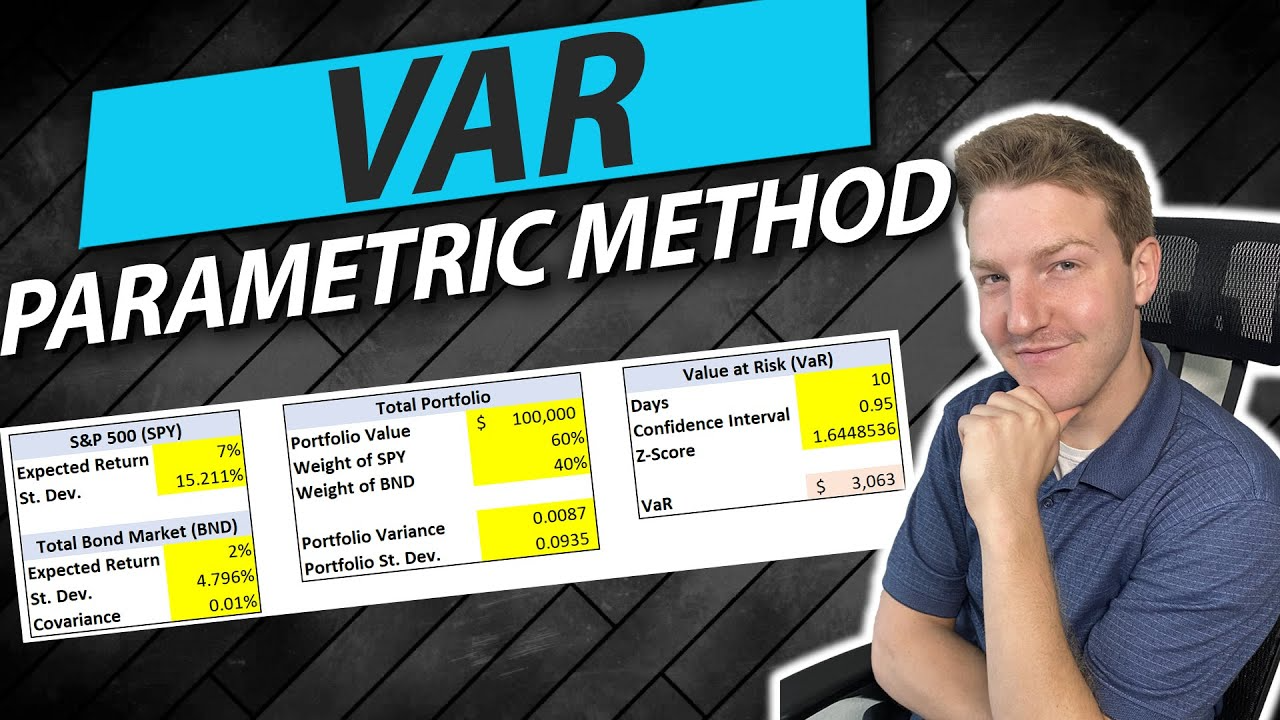

The Value at Risk (VaR) Excel Workbook, expertly developed by Ryan O’Connell, CFA, FRM, offers an insightful and practical resource for finance professionals and students to assess and manage financial risk using the Historical Method. This user-friendly tool allows for calculating daily stock price returns, defining portfolio assumptions, determining daily profits and losses, and ultimately calculating VaR. It even guides you in creating a VaR Histogram for a visual representation of potential return outcomes. Although not a substitute for professional financial advice, this workbook simplifies complex risk management techniques, making them accessible for practical use and education.

Description

The Value at Risk Excel Workbook, as developed and demonstrated by Ryan O’Connell, CFA, FRM, is a practical and valuable tool that allows finance professionals and students alike to assess and manage financial risk using the Historical Method.

The workbook not only provides you with the mechanism to calculate the VaR, but also breaks down the process into several comprehensible steps such as calculating daily stock price returns, defining portfolio assumptions, and finding daily profits and losses. It presents complex calculations in a user-friendly manner, enabling users to understand and implement the concepts effectively.

The defining feature of the product is its step-by-step instructions for calculating VaR using the Historical Method. This feature allows users to quickly compute the potential risk in their portfolio and express it in monetary terms. Moreover, it includes a section for creating a VaR Histogram, a visualization tool that presents the distribution of possible return outcomes and the likelihood of occurrence, enhancing your ability to communicate and understand risk.

Built upon the expertise of a professional in the field, this Excel Workbook comes with an assurance of quality and efficacy. The workbook can be downloaded directly from the provided link, offering a user-friendly interface that blends sophistication and simplicity.

Note: This tool is meant to guide your understanding and application of the VaR Historical Method. It should not be considered as financial advice. For comprehensive advice or analysis, please seek professional consultation.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|