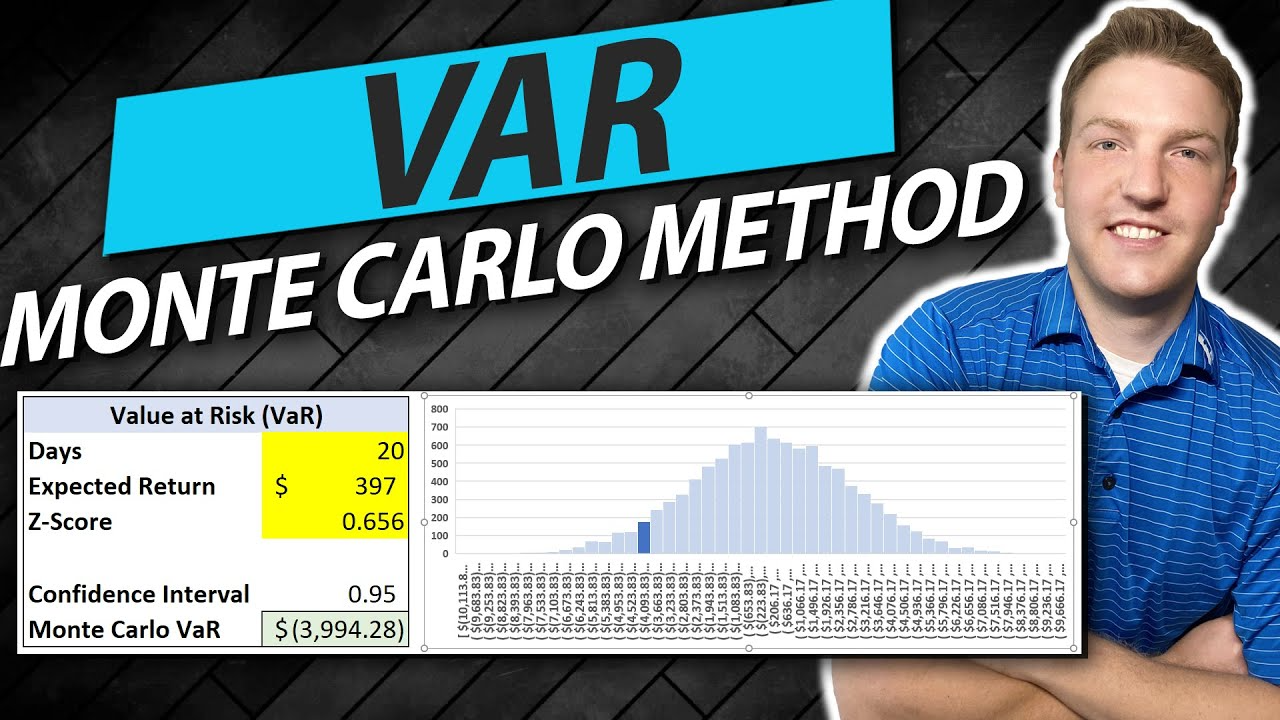

Monte Carlo Method: Value at Risk (VaR) Excel Template

Price range: $0.00 through $20.00

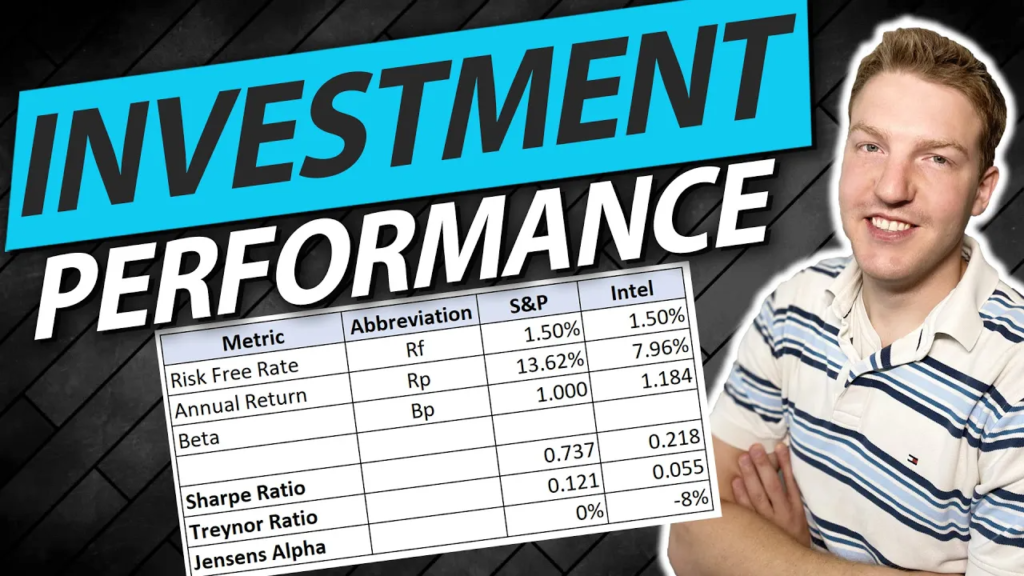

The Monte Carlo Method: Value at Risk (VaR) Excel Template is a comprehensive tool. Whether you’re a finance professional, a student, or a DIY investor, this template provides an intuitive guide for conducting advanced financial risk analysis. From calculating daily returns and security standard deviation to interpreting Value at Risk (VaR) through a histogram, this Excel template demystifies complex risk assessment techniques. Included is a free, downloadable file demonstrated in the video tutorial, allowing users to understand and apply the Monte Carlo VaR calculation process in a practical context. Remember, this tool is for educational purposes and should not be taken as financial advice. Leverage this resource to gain a clearer understanding of your portfolio’s risk and make more informed investment decisions.

Description

Whether you’re a finance student, a professional risk analyst, or a hobbyist investor, this Monte Carlo Method: Value at Risk (VaR) Excel Template is an essential tool that will enable you to perform sophisticated financial risk assessments. Crafted by Ryan O’Connell, a certified CFA and FRM, this template offers an in-depth walkthrough of how to calculate Value at Risk (VaR) in Excel using the Monte Carlo Method.

Key Features:

- Calculating Daily Returns Using Yahoo! Finance Data: Understand the daily volatility of a given security with this easy-to-use setup. All you need is the historical pricing data.

- Calculating Security Standard Deviation and Covariance: Assess the relationship between multiple securities and their associated risk, helping you make informed decisions about your investment portfolio.

- Creating Assumptions for Portfolio: Identify and apply critical assumptions to your investment portfolio to achieve more accurate risk assessments.

- Calculating Variance and Standard Deviation of Portfolio: Utilize essential statistical tools to gain insights into your portfolio’s risk profile.

- Calculating Value at Risk (VaR) Using the Monte Carlo Method: Incorporate this advanced financial modelling technique into your toolkit to simulate the potential downside risk of your portfolio.

- Interpreting VaR through a Histogram: Visualize your VaR calculations for an intuitive understanding of your portfolio’s risk.

This product provides a powerful, yet user-friendly platform for financial risk analysis, allowing you to understand the intricacies of portfolio management and make sound investment decisions. Please note, this is an educational tool and not meant to be taken as financial advice.

Included in this product is a free downloadable Excel file created in the accompanying video tutorial, offering a hands-on learning experience. Users are encouraged to manipulate the data and play around with various inputs to fully understand the Monte Carlo VaR calculation process. Please refer to the video for a step-by-step guide on how to use this template.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|