Payback Period and Discounted Payback Period Calculation Excel File

Price range: $0.00 through $20.00

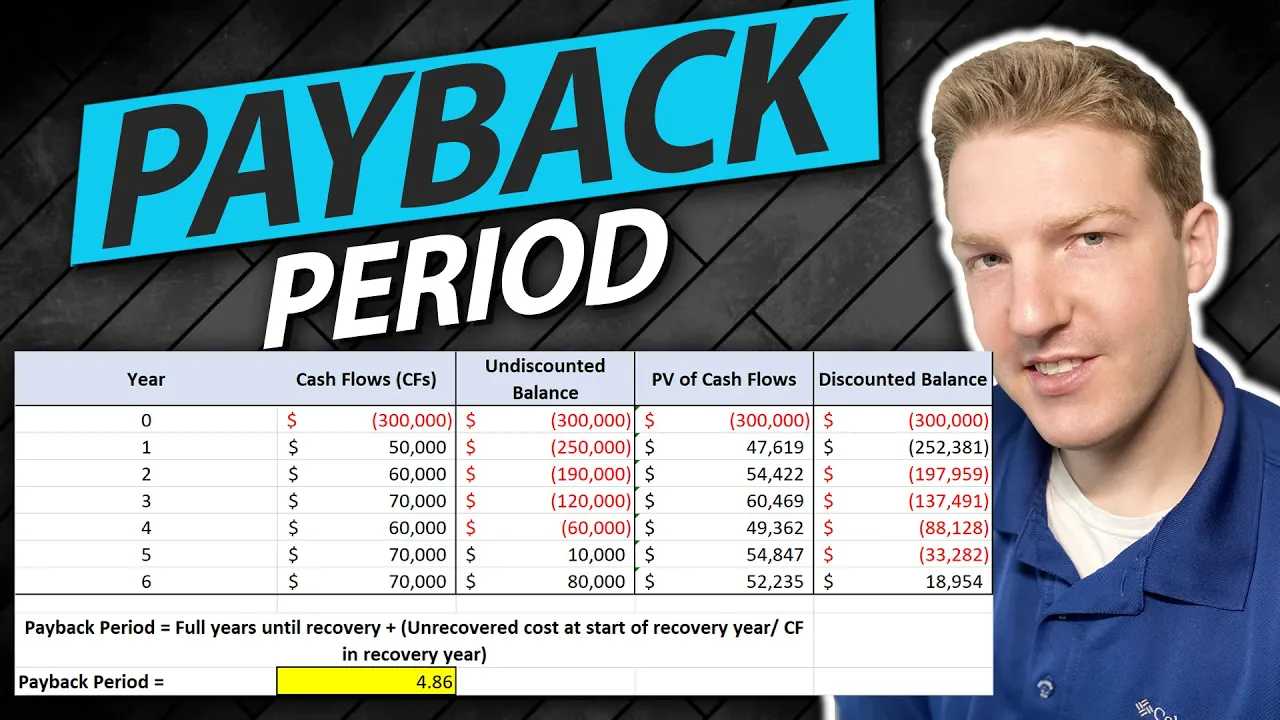

Dive into the world of finance with the “Payback Period and Discounted Payback Period Calculation Excel File.” This comprehensive Excel resource guides users in calculating vital financial metrics such as the Payback Period and Discounted Payback Period, along with providing essential steps to calculate the Undiscounted and Discounted Balance using cash flows. An ideal resource for finance students and professionals, it serves as an excellent educational tool for understanding and evaluating the time taken to recoup investment costs, taking into account the time value of money. Please note that this file is designed for educational purposes and should not replace professional financial advice.

Description

Effortlessly understand your financial investments with this comprehensive Excel file, designed by Ryan O’Connell, a seasoned CFA, FRM, and demonstrated expert in financial modeling and valuation. This powerful tool will guide you in calculating both the Payback Period and the Discounted Payback Period, key metrics used by investors and finance professionals to evaluate the time it takes to recover the cost of an investment.

Within this Excel file, you will find:

- Undiscounted Balance Using Cash Flows: Learn how to calculate the undiscounted balance of an investment over time, an essential step in understanding the overall cash flow situation of your investments.

- Payback Period Calculation: Gain knowledge on how to determine the payback period using Excel. This vital financial metric measures how long it takes for an investment to repay its initial cost out of the cash inflows that it generates.

- Discounted Balance Using PV of Cash Flows: Master the calculation of the discounted balance, which involves determining the present value (PV) of future cash flows. This is critical for making informed decisions about investments, considering the time value of money.

- Discounted Payback Period Calculation: Understand how to compute the discounted payback period using Excel. This calculation is an extension of the payback period calculation that takes into account the time value of money.

This file is intended for educational purposes only and should not be used as a substitute for professional financial advice. It is the perfect resource for both finance students and professionals looking to hone their skills and understanding of these critical financial metrics.

Note: This Excel file is an automatically downloadable resource featured in the video “How to Calculate Payback Period and Discounted Payback Period. Please refer to the video for detailed steps on how to use the file.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|