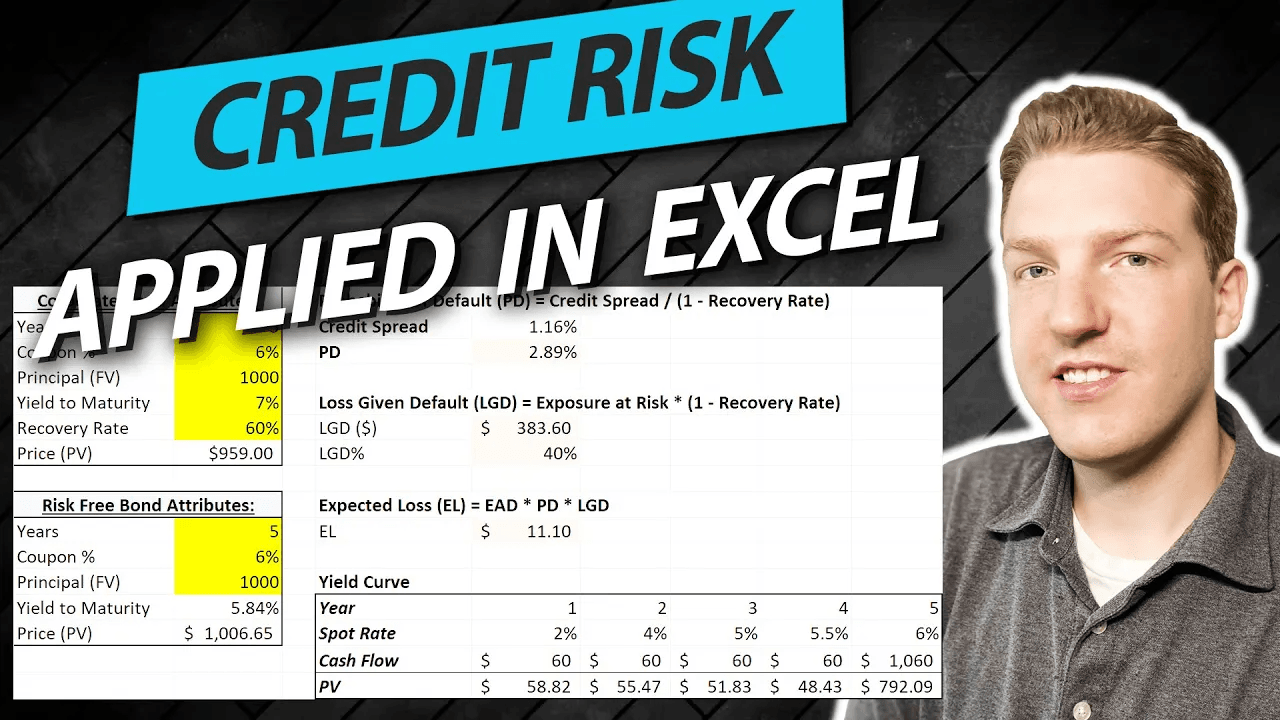

Probability of Default (PD) and Loss Given Default (LGD) Excel Template

$0.00 – $20.00

The Probability of Default (PD) and Loss Given Default (LGD) Excel Template, curated by financial expert Ryan O’Connell, is a comprehensive tool for risk evaluation. This Excel template provides a systematic approach to compute significant risk metrics, such as the Present Value of a Risky Corporate Bond, Yield to Maturity (YTM) of a Risk-Free Bond, Credit Spread, Probability of Default (PD), Loss Given Default (LGD), and Expected Loss (EL). It’s an invaluable resource for financial analysts, risk managers, and anyone interested in understanding and calculating credit risk. Please note, this tool is for educational purposes and users are encouraged to seek professional advice for financial decisions!

Description

Unveil the art of financial risk calculation using this comprehensive Probability of Default (PD) and Loss Given Default (LGD) Excel Template. This template serves as an essential tool for risk managers, financial analysts, and anyone interested in understanding the riskiness of a corporate bond.

Following the layout of the informative video tutorial, this Excel Template covers a series of calculations, including:

- Present Value of Risky Corporate Bond: Begin your risk analysis by calculating the present value of the corporate bond under consideration.

- Yield to Maturity (YTM) of the Risk-Free Bond: Understand the return on investment for a risk-free bond, providing a comparative benchmark for your risk analysis.

- Credit Spread: Evaluate the difference between the yield of a corporate bond and the risk-free bond to determine the additional yield a risky bond offers over a risk-free bond.

- Probability of Default (PD): Calculate the likelihood that a borrower will default on a financial obligation.

- Loss Given Default (LGD): Measure the potential loss to the investor or lender if the borrower defaults on their obligations.

- Expected Loss (EL): Estimate the total loss potential considering the default probability and potential loss given a default.

Download this template to deepen your understanding of credit risk evaluation. This template will streamline your calculations and aid in your credit risk decision-making process.

Please note: This is a tool for understanding financial risk calculations and should not be used as the sole basis for any financial decisions. Users are advised to seek professional advice before making any significant financial decisions.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|