Financial Analysis Excel File for NPV and IRR Calculations

Price range: $0.00 through $20.00

The Financial Analysis Excel File for NPV and IRR Calculations is a powerful, user-friendly tool. This comprehensive Excel file allows users to calculate and understand crucial financial metrics, such as the Net Present Value (NPV) and the Internal Rate of Return (IRR) of a project. Users can define expected cash flows, calculate present and net present values, experiment with different assumptions, and apply NPV and IRR decision rules. This free resource is perfect for those involved in project financing, investment decision-making, or financial analysis. Please note that this tool is intended for educational purposes and is not financial advice!

Description

Leverage the power of Excel in your financial analysis with this comprehensive tool designed by Ryan O’Connell, CFA, FRM. This Excel file enables users to calculate Net Present Value (NPV) and Internal Rate of Return (IRR) for any project, providing critical insight into the potential profitability and financial feasibility of investments.

Key features include:

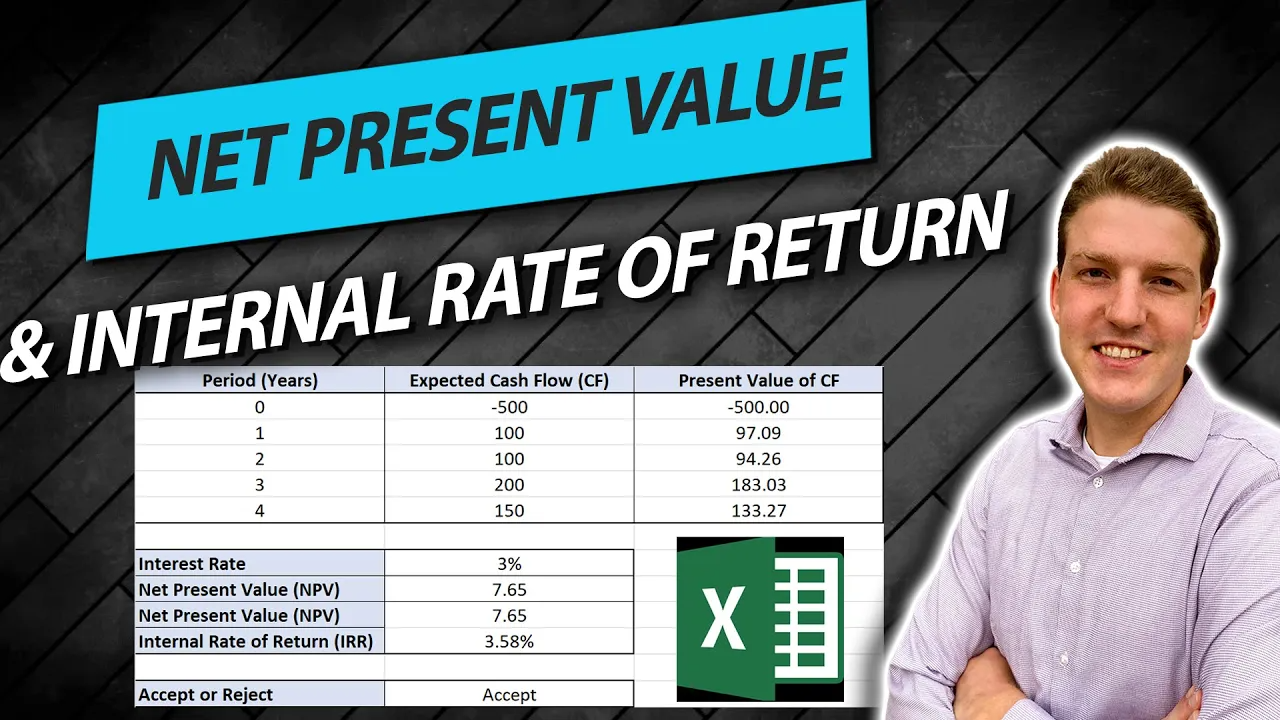

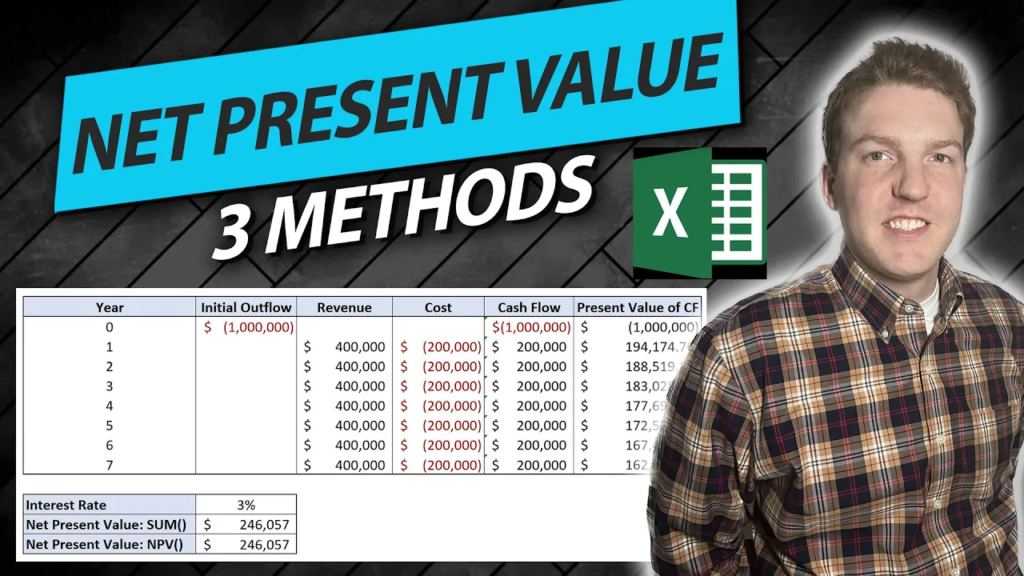

- Expected Cash Flow Definition: Define your project’s expected cash flows over time, allowing you to consider both incoming revenues and outgoing costs.

- Present Value (PV) Calculation: Calculate the present value of each cash flow, providing a snapshot of the future earnings in today’s terms.

- Net Present Value (NPV) Calculation: With this function, users can determine the net present value of a project, a critical factor in investment decisions.

- Internal Rate of Return (IRR) Calculation: This powerful feature helps users calculate the internal rate of return for a project, a critical metric for understanding the expected growth of an investment over time.

- NPV and IRR Decision Rule: The file also includes guidance on the accept or reject rules for NPV and IRR, helping users make more informed investment decisions.

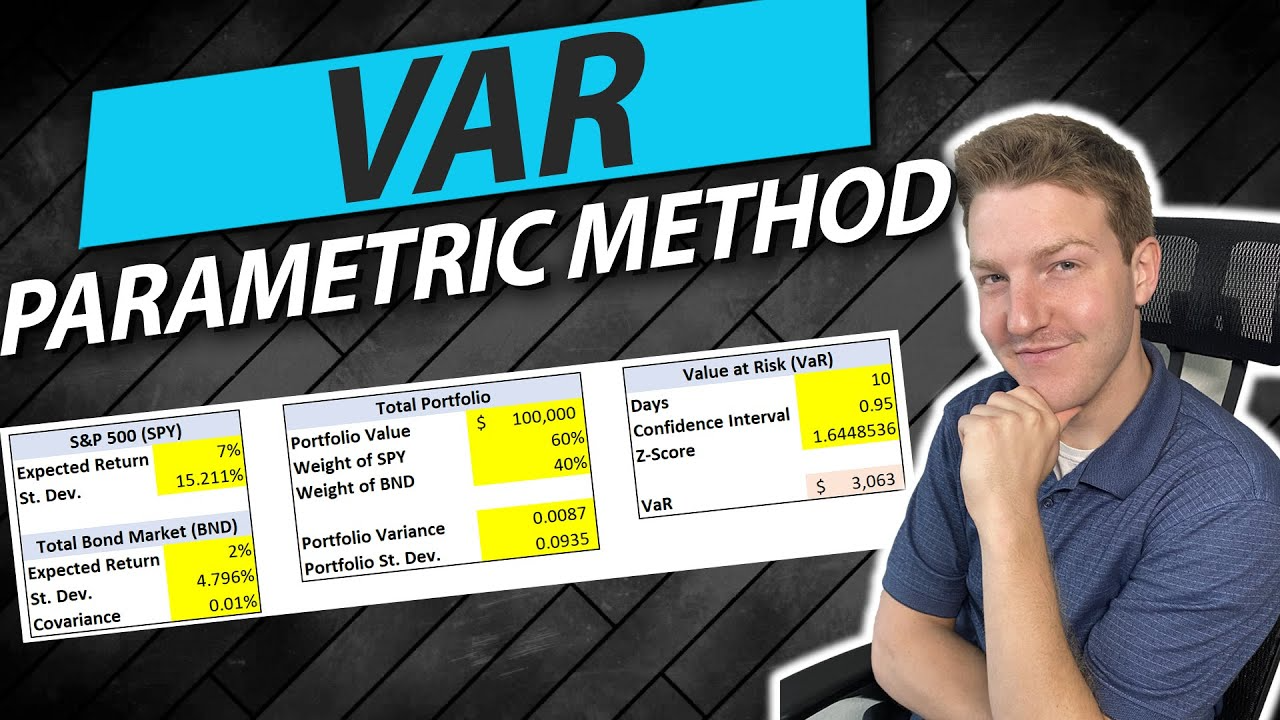

- Assumptions Experimentation: With this feature, users can alter the assumptions of their project, allowing for a better understanding of the potential outcomes and risks associated with different scenarios.

This is a valuable resource for anyone involved in project financing, investment decision-making, or financial analysis. It’s free to download and user-friendly, making it accessible for both finance professionals and those new to financial modeling.

Please note, this product is intended for educational purposes and should not be taken as financial advice.

Additional information

| Select What You Think This Is Worth | $0, $5, $10, $20 |

|---|